Finance

Financial Advice to Married Persons

Financial Advice to Married Couples

o Work TOGETHER on your finances!

o Discuss all major purchases BEFORE making the purchase.

o Share ALL FINANCIAL INFORMATION with each other.

o No financial secrets.

o If you work TOGETHER, it will make you stronger.

o Avoid the trap of debt

o Some couples shell out thousands just for their marriage!

§ It is nice to have a great wedding, but to go into debt to do it?

§ Is it worth it?

o After many couples get married, they attempt to get everything that their parents have:

§ House

§ Furniture

§ Cars

§ Boat

o As a result, the first thing they have done as a couple was to strap themselves down under a weight of payments.

o Develop a plan for your future. Make your financial plan support your future plan!

o I recommend that a newlywed couple WAIT at least one year before making any large purchases (> $1000).

o SAVE money for emergencies.

o When you have no savings, every little thing that happens wrong to you (car problem, appliance problem, medical bill) becomes a financial emergency.

o Financial emergencies lead to STRESS.

o With 3 – 6 months of savings JUST SITTING THERE, these financial emergencies will not exist and therefore the stress will also not exist.

o SAVE money for the future!

Ask the following questions:

o Is the fact that you are going to retire someday unknown?

o Is the fact that your children are going to college someday unknown?

o Is the fact that your children are going to get married someday unknown?

o Is the fact that you are going to purchase a house someday unknown?

o Is the fact that you want to go on a nice vacation to Hawaii someday unknown?

o Is the fact that you want to buy a nice boat someday unknown?

o Is the fact that you want to own a nice car someday unknown?

o Is the fact that you want nice furniture someday unknown?

o NONE of these questions are unknown, yet many of us NEVER EVEN BOTHER TO PLAN FOR THEM!!!! The result of NOT PLANNING? They either go ahead with these goals and incur a TON OF DEBT OR they are unable to realize their dreams and instead live a lifetime of woulda, coulda, shoulda regret.

o Pay cash for purchases.

o Saving money takes time.

o Time allows you to truly understand if you really want that item

o It also allows you time to learn what a good deal is for that item

o Hold each other accountable.

o When one of you gets the I want this!!!-itis, the other can calm you down!

o You are stronger TOGETHER.

o Remember: ISOLATION = DESTRUCTION

o HAVE FUN WITH THIS!!!

o Managing your money can be fun. Done correctly,

o It allows you to support VERY WORTHY causes that you strongly believe in!

o It allows you to save more than you ever thought possible.

o It allows you to spend more than you ever thought possible.

o It allows you to give more than you ever thought possible.

Systematic Savings & My 529 Plan

“Was it really 4 years ago that we last talked?”

“Our 20 year high school class reunion is THIS YEAR?!?!!”

Time has remained constant, but as we grow up we get so busy that it really does appear that time flies by!

It was almost 7 years ago that my daughter was born. WOW! I can not hardly believe it. In just 11 years, she will be off to college. UNBELIEVABLE!

Wait a minute … Off to college … Have I started saving for that?

The answer for us is YES!

Here is what we have done to save for her college. We started up a 529 College Savings Plan. It was VERY EASY. I went to our local bank and asked to open a 529 College Savings Plan.

Facts about the 529 College Savings Plan I am involved in:

- They required a mere $50 minimum amount to open the account.

- Additional future contributions were required to be at least $25.

- They ZAP my bank account once a month with an amount I have told them to deduct.

- The money is invested in mutual funds that I have selected.

- The money is put in AFTER-TAX, but I am able to withdraw the money (principal PLUS interest) TAX-FREE for my daughters qualified educational expenses.

- I am ONLY allowed to contribute $298,770 to this account at this time (I suspect that this will pay for college 🙂 )

- Qualified expenses included tuition, fees, books, supplies, equipment, room and board.

- If I withdraw the money for non-qualified expenses, the interest earned is subject to income taxes PLUS a 10% penalty.

Do you know how easy it is to contribute a monthly amount to savings when you do not have to do anything? No writing checks. No on-line bill payment. Nothing. It is removed from my checking account automatically, and it is deposited into the 529 account automatically. It is then automatically used to purchase additional units of the mutual funds I have selected.

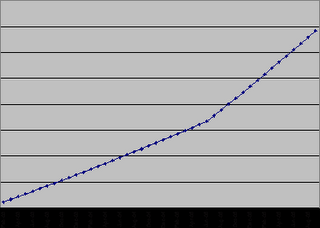

How sweet is that? Here is an example of what has happened to my 529 plan since it was started in 2003.

There is POWER in writing things down!

Have you ever told someone that you would do something, and then forgot to do it? That has happened to every one of us.

I remember going to visit a customer that had experienced a quality issue with one of our products. I had a belief that we had not been notified in a timely manner about the quality issue. I was WRONG. This customer pulled out a book and rattled off at least 10 times that he had contacted our team about this exact issue! He had NAMES. He had DATES. He had TIMES. He had the Greenwich Mean Time in which he had contacted them. He had EXACTLY what he had relayed to each individual. There is POWER in writing things down!

By the time he had gotten to relaying to me the fourth call he had made, I really was not interested in hearing any more! I just wanted OUT OF THERE. Why? Because I did not have it written down. My team had not written it down. As a result, we had seriously inconvenienced a customer, and we had look foolish doing it. There is POWER in writing things down!

With this blog, I embarked on a journey to write about personal finances. I wanted to help others improve their own personal financial situation. The end result? I am personally learning more about finances. Why? Because I am writing it down!!! There is POWER in writing things down!

God had approximately 40 authors WRITE THINGS DOWN. Why? Because there is POWER in writing things down!

Write things down! Use the POWER!

Moving Costs – If you ever move …

Moving costs money.

Surprised?

Here are some questions (answers below):

- How much does it cost to rent a one-way 26′ box truck for 5 days and unlimited miles?

- How much does it cost for boxes?

- How much does it cost for the fuel to get from point A to point B?

- How much does it cost to rent a car tow dolly?

- Have you thought about furniture pads?

- How much does it cost to get your old house ready to move out of?

- How much does it cost to get your new house ready to move in to?

- If you are selling your home, how much does it cost?

- One-way rentals are FAR more expensive than returning the rental to the spot you picked up the truck. General costs for a one-way rental is between $1,300 and $2,500.

- Boxes. Wow. Moving boxes that you purchase run anywhere from $150 – $500.

- Fuel? Depends on the average gas prices. 26′ box trucks get HORRIBLE gas mileage – between 4 and 7 mpg. If you get a diesel, you can expect to get between 8 and 12 mpg.

- A car tow dolly will run you around $200

- Furniture pads are very cheap. Around $10/dozen. Get at least two dozen more than you think you will need.

- Depends greatly on the condition of the home. If you’ve maintained things well, it could be $500 or less. If you haven’t maintained things well, it could be a LOT more.

- Depends greatly on the condition of the home. If you negotiate effectively, you can have the house handed over in great condition.

- If you use a realtor, selling fees on a home generally run between 4% and 7%. If you sell your home yourself, you can do it for somewhere around $1,500.

Does God want you to be rich?

So I was briefly reviewing the web pages that I check daily, and I found this article on www.cnn.com. The question being asked is, “Does God want you to be rich?”

Very interesting question, indeed.

The question is often asked. It is interesting to see it being approached by Time Magazine.

I would like to ask the question another way. Does God want you to be poor?

In financial counseling, I have never personally encountered anyone who became poor because God made it that way. There is this one man I have read about in the Bible. His name was Job. You can read about him here. After all of his wealth was stripped away, he still honored God. In the end, God blessed him even more in the last days of his life than at the first.

I do not know how often God lets individuals become poor on purpose (like Job), but I have seen example after example after example where poor decisions have been made that led to the person or couple becoming financially strapped.

Let me list some “poor” decisions.

- A car financed for 6 years with payments that really can not be afforded. Especially when the vehicle insurance, license plate, and property taxes also go up with the new vehicle.

- A house with a payment that consumes 50% of take-home pay.

- A piece of furniture or a ATV that they could not pay cash for and so it was financed for 4 years at 20% interest.

- Not having an emergency fund with at least $2000 in it. How realistic is it to believe that there will never be a financial emergency in our life?

- Not thinking about purchases overnight. They are talked in to making a purchase of something they did not NEED by a very talented salesperson. So they bought and now they are paying. (Timeshares are very spur of the moment decisions that are many times a BAD deal.)

- Not putting money away for the children’s college. If you really do want to help your children out with college, you really should start saving for them. They really are growing older every single day and they will be 18 and headed there before you know it!

- Not putting money away for your retirement. The word “tire” is in retirement because someday you are going to be very “tired”! If you do not put away money, you will be working when you are very “tired”!

I could list MANY more …

I believe that God has given us this thing called “common sense” and this other thing called a “brain”. He created us in His image. He wants us to think about things. He equipped us to be able to think about purchases and how we should handle our money.

If we truly stopped and thought about our purchases and our overall money management, we would be able to avoid being poor. We could even achieve wealth.

To get it, we need only understand these three things:

- God is in control

- INCOME – OUTGO = EXACTLY ZERO

- We are the managers of our money. We are in control of where our money goes.