Finance

What Everyone Should Know About Getting A Degree

I could never have attended Purdue University had it not been for student loans. I began dating Sallie Mae right away, and it took years for me to break up with her.

As we continue our discussion surrounding graduation, here are some points about getting a degree and student loans from my book – What Everyone Should Know About Money Before They Enter The Real World. This is a great resource for those currently graduating high school or college.

- Go to school for 4 years for a 4 year degree (or for 2 years for a 2 year degree). Not six years for a four year degree. This can have substantial financial consequences. For example, if you attend college for two years more than required for the degree, you will have to pay for two extra years of school PLUS you will forfeit the salary you could have earned during that two year period. For many people this is a $100,000 financial swing!

- Obtain a degree that will help you repay the loan. There are many people who go to prestigious private colleges to obtain a degree that is the equivalent to underwater basket-weaving. While I think that underwater basket-weaving would be amazingly cool, it probably won’t help repay the loans. My mechanical engineering degree from Purdue University and MBA from Clemson University certainly helped me repay my student loans.

- Tech or Community College for the first two years can really lower costs. Most states have established programs that allow all credits earned during the first two years of community college to transfer directly to the state schools. I have seen the costs for community college. They are much lower than state or private universities. The local community college where I live is literally one-third the cost of the state school.

- Obtain subsidized loans, if possible. Subsidized loans do not accrue interest while the student maintains at least half-time student status. They also do not accrue interest while the loans are in grace periods or deferment.

- The name of the college does not matter nearly as much as the effort you put into your studies. Many students fall in love with a particular college and feel that they just must attend only that institution. I have discovered that no one really cares about the fact that I went to Purdue and Clemson – all they want to know is if I can help them accomplish their stated objective.

Print this out and have a conversation about it with your student or future student. My bride and I have been talking about this with our daughter since she was six or seven. I know it might seem like boring conversation, but I promise you that it has had a positive impact on our daughter and the plans she has made for education.

I have written an entire chapter on this topic in my book for high school and college students – What Everyone Should Know About Money Before They Enter The Real World – I promise you it will help financially prepare your student for the real world. You can purchase that book HERE or for your e-reader HERE.

5 Essentials to Paying Off Debt – Step 5

In this series, I want to equip you to become debt free!! Jenn and I became debt free in just 14 months by following this process. I can tell you this – there is NOTING like living life without the weight of debt!

STEP 1 – Understand the WHY before the HOW

STEP 2 – Calculate your Debt Freedom Date

STEP 3 – Accelerate your debt elimination

STEP 4 – Use the Debt Snowball Technique

STEP 5 – Establish Accountability

The strongest among us can still fall to temptation! You could be making fantastic progress toward debt freedom and then a new truck pulling a new boat passes you on the road. If you’re not careful, you’ll also be pulling a new truck and boat down the road!

There are two key ways to ensure you are held accountable to your goal of debt freedom!

- If married, work together with your spouse. If unmarried, have someone you trust (someone who has won with their money) hold you accountable!

There is incredible power when you work together with your spouse towards debt freedom! It is a common goal that will unify your marriage and cement your commitment to managing your resources together.I have also found that when I have a bad case of the “I wants” and “I gotta-have”, Jenn does not. She shuts me down! Then, when Jenn gets a bad case of “I really want this”, I do not. I shut her down! Why? Because we are not doing debt! We are THROUGH with it!! - Plan your spending every single month!

Planned money goes farther than unplanned money! Every single month, Jenn and I still down TOGETHER and spend every single dollar on paper before we are paid. Don’t miss this!! Every. Dollar. On. Paper. BEFORE. We. Are. Paid.I can tell you this. I HATED the idea of budgeting and now all I do is yell from the mountaintops about how important it is and how EZ it is to budget! There are FREE budget tools that are available HERE. Use one of them to start your journey to debt freedom! Your budget will hold you accountable. I wouldn’t be surprised if it helped you free up $200-$500 per month to attack your debt even harder.

Also, make sure to add some FUN into your liberation from debt! I know that money can make you so frustrated that you want to pull all your hair out, but add some fun into it! You could make your debt pay off visual. Check it out HERE.

To learn more about becoming debt free, check out my book, I Was Broke. Now I’m Not.

5 Essentials to Paying Off Debt – Step 4

In this series, I want to equip you to become debt free!! Jenn and I became debt free in just 14 months by following this process. I can tell you this – there is NOTING like living life without the weight of debt!

STEP 1 – Understand the WHY before the HOW

STEP 2 – Calculate your Debt Freedom Date

STEP 3 – Accelerate your debt elimination

STEP 4 – Use the Debt Snowball Technique

We can all agree that debt is a drag. It hangs on like a bad relationship or a fixer-upper money pit house. Anyone, when given the choice, would choose to be debt free over paying debt payments every month.

The average family possess credit card debt, student loan debt, furniture debt, vehicle debt, and a personal loan or two. Then a house payment enters into the picture. Every single month, 40% or more of the family’s income is “dead on arrival” because it must immediately be sent out to lenders. Let’s work on changing that!

With Steps 1-3 complete, we can now focus on actually paying off the debt using the Debt Snowball Technique!

Let me explain the process for using the Debt Snowball Technique.

- List ALL debts from the smallest balanced owed to the largest.

- Pay the minimum payment on all debts except the smallest one.

- Pay as much as you can on the smallest debt.

- When the smallest debt is eliminated, take the monthly payment you were paying for that debt and add it to the monthly payment you’re making on the second smallest debt.

- Continue this process with a vengeance until you are debt free!!

I highly recommend this technique because you will see individual debt payments disappear more swiftly from your monthly budget. For more information on the Debt Snowball Technique, grab a copy of my latest book, I Was Broke. Now I’m Not.

5 Essentials to Paying Off Debt – Step 3

In this series, I want to equip you to become debt free!! Jenn and I became debt free in just 14 months by following this process. I can tell you this – there is NOTING like living life without the weight of debt!

STEP 1 – Understand the WHY before the HOW

STEP 2 – Calculate your Debt Freedom Date

STEP 3 – Accelerate your debt elimination

DEBT – This four letter word often consumes so much of our lives, thoughts and actions. But, it doesn’t have to!

When it comes to debt, I understand how stressful and frustrating it can be. I understand the weight and fiction it can bring to a family. However, I also know the freedom that comes when one become debt free and I want you to experience this freedom!

When you are ready to start attacking your debt, here are a few ways to accelerate debt elimination. (But before you begin, make sure you’re not making the #1 Debt Mistake – HERE.)

3 Ways to Accelerate Debt Elimination:

- Reduce Interest – Many people with substantial consumer debt do not realize that 50% – 75% of their payments are merely going to the lender as interest. This greatly reduces your ability to lower your debt. So, here are a few ways to lower your interest:

- Transfer to a 0% Interest Credit Card (Learn more HERE)

- Call & ask for a lower rate

- Pay on-time

- Establish automatic payments

- Increase Income – Since we’re all friends here, if we’re being completely honest, we all vote for this option, right? But a lot of people don’t realize that there are numerous ways to increase income that are within your hands. Here are a few:

- Pay Raise (see salary.com)

- Tax Refund

- Bonus

- Work Overtime

- Extra Job

- Sell Some Possessions

- Decrease Outgo – This is an option that is always available to us, but it’s probably not fun. If you can decrease the outgo to other things, you can increase the outgo to liberating your life from debt!

- Create and follow a budget!

- Sell some possessions

You can learn more about each of these steps in my book, I Was Broke. Now I’m Not.

5 Essentials to Paying Off Debt – Step 2

In this series, I want to equip you to become debt free!! Jenn and I became debt free in just 14 months by following this process. I can tell you this – there is NOTING like living life without the weight of debt!

STEP 1 – Understand the WHY before the HOW

STEP 2 – Calculate your Debt Freedom Date

When I meet with people, it’s a guarantee that I will calculate their debt freedom date. When I do this, it’s clear that people do not like debt! It’s also apparent that people have not been paying attention to their finances and do not have a well-defined plan for their life. Otherwise, they would not have incurred most of the debt. However, there is always HOPE and a way out!

In these meetings, I often use the example of a dragon. Follow me here! How can you effectively defeat a dragon if you don’t know how many heads it has or how large the dragon is? So, before we calculate your debt freedom date, let’s establish three things:

- Who do you owe

- How much do you owe

- What are the payments that you are ACTUALLY making

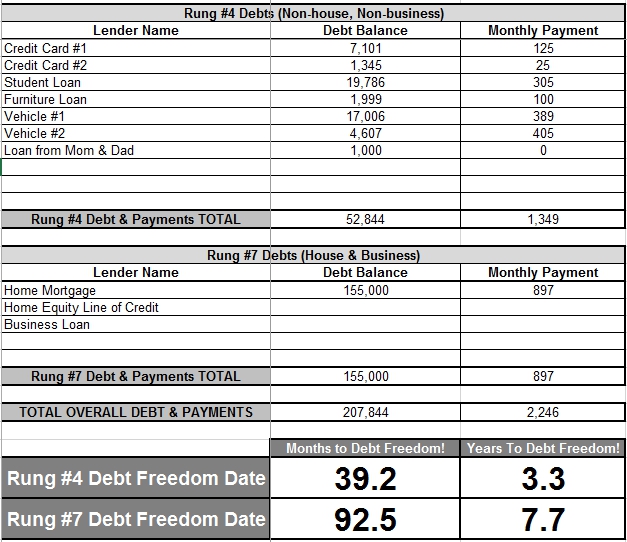

You can list these on the Debt Freedom Date Calculator. Now we can calculate your debt freedom date! This date is simply the date that you will be debt free (including and excluding the house).

Let’s look at a sample. In this sample, the couple listed all of their non-house, non-business debts, as well as their house debt. After all of the debts are inputted, the debt freedom date is calculated. This couple will be debt free, excluding the house, in just 3.3 years and completely debt free, including the house, in 7.7 years!! Get fired up!

Are you ready to take your next step? You can calculate your debt freedom date HERE!

IMPORTANT NOTE: When you take this next step to become debt free, you must eliminate the potential for new debt! If you keep swiping the credit cards and running up the balance, you’re just eliminating your potential of becoming debt free.

Have you calculated your date? How many months until you’re debt free?