Finance

SERIES: Setting Goals – Part Two

Welcome to another series on JosephSangl.com – Setting Goals

I am passionate about helping others accomplish far more than they ever thought possible with their personal finances. I know that the number one way that folks will win with their personal finances is to have a well-written plan and clearly defined goals.

Part Two Determine your mission

What is your mission? The vision is the guiding light for everything your organization does, but the mission answers "what" you are going to be doing right now to accomplish the vision.

The IWBNIN vision is … to help others accomplish far more than they ever thought possible with their personal finances.

This vision is what drives everything we do, but it does not say "what" we are doing right now to accomplish it. The mission should say what the key focus is for the next several years. The IWBNIN mission statement does that.

The IWBNIN mission is … to teach personal finances to 100,000 people by October 2011.

This mission is a (somewhat) manageable chunk that clearly defines our focus right now. It seemed like such a huge mission back in 2006 when we set it. But with the NewSpring growth rate, we might be running 100,000 people by October 2011! Awesome!

One more thing about your vision and mission. If they do not FIRE YOU UP, you probably have not nailed it down. As I simply typed the words in right now, I literally YELLED out loud. It FIRES ME UP! I can not believe I get to do this stuff for a living.

Take some time to write out a (somewhat) manageable mission that will guide your efforts for the next few years. Then go read Part Three.

SERIES: Setting Goals – Part One

Welcome to another series on JosephSangl.com – Setting Goals

I am passionate about helping others accomplish far more than they ever thought possible with their personal finances. I know that the number one way that folks will win with their personal finances is to have a well-written plan and clearly defined goals.

Part One Clearly define your vision

Where are you headed? What is it that sets your soul on fire? What makes you wake up every morning and say, "Good morning, Lord!" instead of "Good Lord, it's morning."?

Without clear vision, it becomes difficult to set goals.

If you do not have a clear vision of where you are headed, then it might be that your vision statement would be "To find out and do EXACTLY what I have been put on this earth to do".

Write down your vision and ponder on it for awhile and then go to Part Two of this series.

Marching To Debt Freedom – Couple #3 – Month 12

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

Thoughts from Couple #3 this month

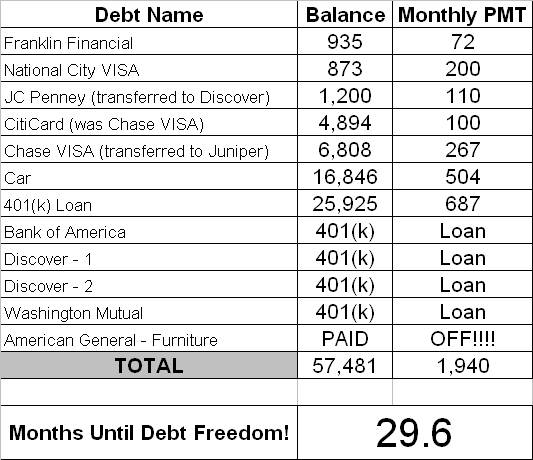

Couple #3 has taken a new job this month so they are very busy right now. Below are their updated numbers.

Updated Debt Freedom Date

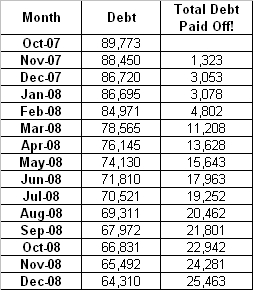

Month By Month Progress

![]()

Sangl says

Couple #3 is going through a job change so things will be interesting over the next several weeks for them. It is very easy to break the routine of planning one's spending during major life changes so it is critical that Couple #3 makes a disciplined effort to keep up with their plan. As you can see, the plan is working!

Readers

When you have went through a major job change that required a move, what did you do to maintain sanity in your financial plan?

Read previous updates from Couple #3 HERE

Marching To Debt Freedom – Couple #1 – Month 15

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now over a year into their Debt Freedom March.

Couple #1's Thoughts This Month

The current economic environment is flipping crazy. I can only think that God had his hand in my wife and I deciding to get out of debt long before this downturn.

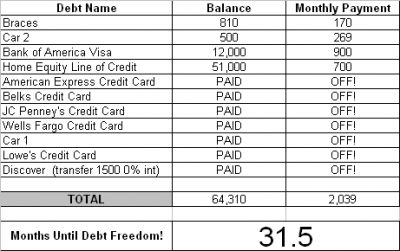

- We paid half the balance of car 2 and owe just $500.

- We increased the payment on the HELOC to $700.

- The property taxes are already paid when in years past I would have to wait until my tax check came back.

- Christmas is bought and paid for and under the tree. Instead of buying useless presents for friends this year, I made gifts out in my shop.

We have a lot to be thankful for. We have our jobs, we have our health, and we have each other. May God bless you all as I have been blessed. Merry Christmas!

Updated Debt Freedom Date

Month By Month Progress

Sangl says

Another excellent month! Couple #1 has a fully-functioning Known, Upcoming Expenses account that has enabled them to stay the course even in difficult economic times. If your budget is constantly smashed by things like property taxes, quarterly insurance premiums, vacation, or Christmas, I highly recommend clicking HERE to learn how to set up a Known, Upcoming Expenses account.

Read Previous Monthly Updates For Couple #1 HERE

How Much Will College Cost?

I read CNN Money's personal finance website everyday. I saw THIS GREAT TOOL, and thought I would share it with you.

The tool is called the "College Cost Finder". Just type in the college you are interested in, and it will tell you how much it currently costs to attend it.

If you have kids, feel free to shudder with cold chills for awhile. Then go to the TOOLS section and use the investment value calculator to figure out how much money you need to save every month so you will be ready to pay cash!