Finance

SERIES: Restructuring Debt – Part Two

Welcome to the latest series at JosephSangl.com – Restructuring Debt

Welcome to the latest series at JosephSangl.com – Restructuring Debt

I am excited to embark on this series of posts because interest paid toward debt is one of the largest obstacles to gaining traction for one's own Debt Freedom March.

Of course, one way to eliminate the interest is to sell some stuff and become debt-free. But I recognize that for some people, they have debt that they are going to have to focus on and just pay it off. If this describes you, then I trust that this series helps you gain speed in your Debt Freedom March!

Part One – Know What You Are Paying

Part Two – Lower The Interest Rates!

There are several ways to lower the interest rate that you are paying on your debt. Here are several ways that have been used very successfully.

Call The Debt Owner

This really catches some people off-guard. For some reason, they believe that the interest rate is truly fixed on their debt. Well, just as "fixed rates" on credit cards are not truly fixed and can be (will be) changed at any time, your "fixed rates" are negotiable.

Paying high interest on a debt? Call the customer service line and try some of these lines out (only if they are true, of course!).

- "I am really trying to eliminate my debt, but these high interest rates are really hurting my ability to do that. Can you please lower the interest rate?"

- "Can you please lower the interest rate on this loan? I have been a very loyal customer, and I could really benefit from some help right now."

- "What can you do to help me lower the interest rate on this loan?"

Things NOT to say …

- "You stink. Your company stinks. You are lying, cheating, good-for-nothing scammers. I wish a 1,000 SPAM e-mails per minute upon your life."

- "You're ugly. You're responsible for the recession. I am going to talk about you on my Facebook page."

The first person you talk to will probably not have the authority to change the terms of your loan. Be persistent and ask to speak to their manager. I have had people tell me that it has taken several separate phone calls before they got their interest rates lowered. Many times in spite of a great effort, folks have been unsuccessful and the interest rate was not lowered at all. That brings us to another option. – Move The Debt – and this will be discussed in the next part of the Restructuring Debt Series.

Receive posts automatically in your E-MAIL by clicking HERE.

SERIES: Restructuring Debt – Part One

Welcome to the latest series at JosephSangl.com – Restructuring Debt

I am excited to embark on this series of posts because interest paid toward debt is one of the largest obstacles to gaining traction for one's own Debt Freedom March.

Part One – Know What You Are Paying

I have said and will continue to say that I believe that the top causes of financial failure are disorganization and the lack of a plan. If you want to gain the maximum traction on your Debt Freedom March, you need to pay the minimum interest possible.

In many of my financial counseling appointments, we add up the amount of interest that is being paid each year, and it SHOCKS the ones who have been paying it! There is something about SEEING IT ON PAPER that really connects us to the fact that paying interest is not a healthy financial plan.

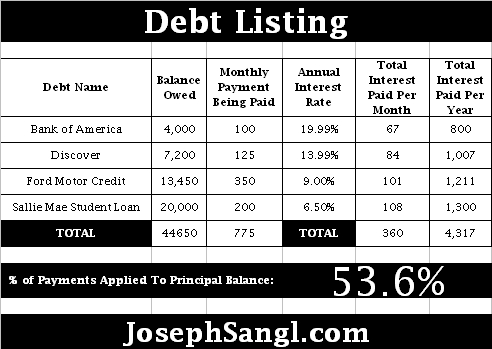

I have developed a tool to help you easily calculate the amount of interest you are paying every month and year. The [download#70#nohits] is an Excel spreadsheet tool that will help you organize your debts and clearly understand the amount of interest that is being paid on the debt.

The form is very user-friendly. All you have to do is enter the debt name, the balanced owed, the monthly payment you are actually paying, and the annual interest rate of the debt. Below is an example.

In this example, you can see that this person has four debts totaling $44,650. The big issue is that $4,317 is being paid in interest every year. In fact, only 53.6% of the monthly payments is being applied to principal reduction.

Now that we are organized it is time to look for ways to reduce/eliminate the interest being paid. That will be covered in Part Two of "Restructuring Debt"!

Receive posts automatically in your E-MAIL by clicking HERE.

Debt Freedom March – Couple #2 – Month 11

Introduction

This couple is THROUGH with debt! It has now been eight months since they announced that they were breaking up with debt. They have agreed to share their Debt Freedom March with everyone in the hopes to inspire others to do the same!

Here is this month's update.

Marching To Debt Freedom – Couple #3 – Month 08

Introduction

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

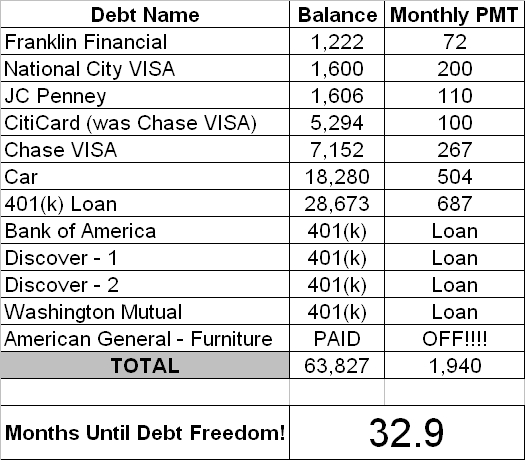

This month's update

We have still increased our payment on the National City card and are determined to get it paid off SOON! We absolutely could not do this without the budget/budget form. It is AMAZING how much that tool helps us! (Get your own budget form HERE)

Struggles? Hmmm… Nothing specific really.

We have transferred two of the credit cards a couple days ago that will show up on the next month's sheet and that what went well! 🙂 More on that one next month!

Updated Debt Freedom Date …

Month By Month Progress …

![]()

Sangl Says …

When Couple #3 started out, they had an incredible level of high-interest debt. The high interest was absolutely crushing their efforts to become debt-free. They have taken the first few months of their Debt Freedom March to restructure their debt such that they can make tremendous strides toward their goal of ZERO debt. Nearly all of the debt has been restructured at this point, and you can see that fact very clear through their progress in just one month. They are sending the same amount toward their debt each month, but now it is nearly all going toward the principal balances.

Watch out Franklin Financial, National City, and JC Penney!

Readers

Do you have high interest debt that is crushing your attempts to lower your debt? Restructure it! A series on restructuring debt will be appearing soon on this wildly popular website known as JosephSangl.com!

Help Is Available!

If you have tried to put together a budget that works and it just is not working, I want you to know that help is available. We provide FREE one-on-one financial counseling here at NewSpring Church – both the Anderson and Greenville campuses. There are about fifteen incredible volunteers who are passionate about helping others win with their money. You can request an appointment by clicking HERE. We even provide a limited number of on-line appointments too!

You might consider picking up a copy of I Was Broke. Now I'm Not. In this book, I spend four chapters telling my family's story of walking out of debt and into financial freedom. In the final nine chapters, I teach the practical tools that we used! It is a fast read at 121 pages, and it might just change your life!

Marching To Debt Freedom – Couple #1 – Month 11

Introduction

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now ELEVEN months into their Debt Freedom March.

Good/Bad This Month

We are really struggling with the economy right now. We are in sales and am currently way below last year's figures. For the first time in twenty years, we laid off people in our home office. Things are really scary. On the bright side, we are not carrying near as much debt as this time last year so we are not creating new debt which to me is the most important thing. I thank God for all we have and pray for those who are struggling way more than my family. Thanks for all of your help and wisdom.

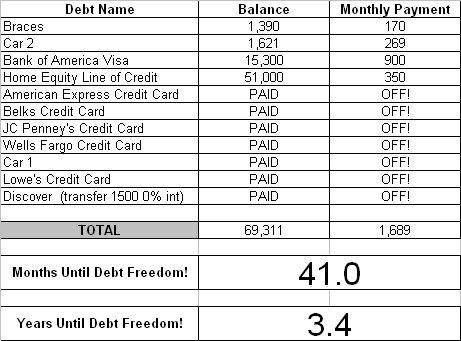

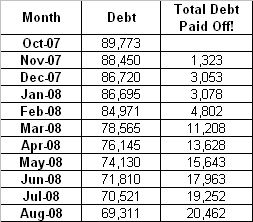

Month By Month Progress

Sangl Says

Another debt has left Couple #1's household! The American Express has been kicked out forever. Nice!

Here is what is so incredible – Couple #1 began attacking their debt just eleven months ago, and they have paid off $20,462! Way to go Couple #1 – I can't wait to see where you guys stand at the end of your first full year of attacking your debt!

Readers …

How is your own Debt Freedom March progressing?

In my book, I Was Broke. Now I'm Not., I share the story of my Debt Freedom March and teach the exact tools that Jenn and I used to become debt-free. You can do it too! You can read the book's introduction HERE.

Receive each post automatically in your E-MAIL by clicking HERE.