Finance

SERIES Teaching My Daughter About Money: Twenty Dollars

Ever since Jenn and I had our I Have Had Enough Moment with living paycheck-to-paycheck and B-R-O-K-E and living the three-time-loser-with-credit-cards life, we have made it a huge priority to teach our daughter about money management. It became a HUGE priority when we realized that she has inherited my "spender" genes!

In this series, I will be sharing some practical ways that we are teaching her about sound money management.

Part One – Twenty Dollars

We recently embarked on the largest and longest vacation of our lives. We traveled from South Carolina all of the way to far western South Dakota via car. The trip consisted of a week at a fishing cabin in northern Minnesota and a week hitting all of the tourist destinations of South Dakota.

As with any type of vacation, we knew that we would be encountering the tourist traps just waiting to take money from our pockets and put it into their pockets. This has been a source of frustration in the past because our daughter would see something she just had to have and begin a full-tilt marketing campaign to obtain it. It starts with asking mom. When referred by her mother to speak to dad, she spins the statement by saying, "Mom said I can get it if you say it is OK." This spin is done to make me clearly understand that I am the bad guy if I say NO and that I am the only barrier to achieving the acquisition of said trinket/junk/trash/souvenir.

Well, I came up with the PERFECT solution for the problem. Jenn and I gave our daughter twenty dollars at the start of the vacation with the following rules.

- When it is gone, there will be no more.

- You can spend it however you want.

- We will not question your purchase, but we will answer any questions you have.

- You can save the money if you want.

The result? Stress-free walks through the tourist traps. On several occasions, I even saw her pick up an item to purchase it and then put it back down. One time she had picked up the bag to fill up with painted rocks (painted rocks! what an idea!) and she put it down, announcing, "They are really pretty, but they would just sit around at home."

Did she save any money to bring home? Nope. She is a spender through and through, BUT she followed the rules and it prevented a lot of frustration.

Here are the lessons I think are being learned or reinforced:

- Money is limited. If you spend it all now, there will be nothing left in the future.

- Cash limits impulsive spending. For spending categories that are susceptible to impulsive purchases, it is very helpful to plan ahead and take cash. You can not overspend cash.

- Opportunity cost. If you buy a particular item, what was the next best thing that money could have purchased.

- She is a spender. It is very helpful to recognize your own spending behavior. My wife is a super-duper-saver. She saves money. She hates to spend money. I am a HUGE spender. Check that. I am a reformed-spender.

Receive each post automatically in your E-MAIL by clicking HERE.

Marching To Debt Freedom – Couple #3 – Month 07

Introduction

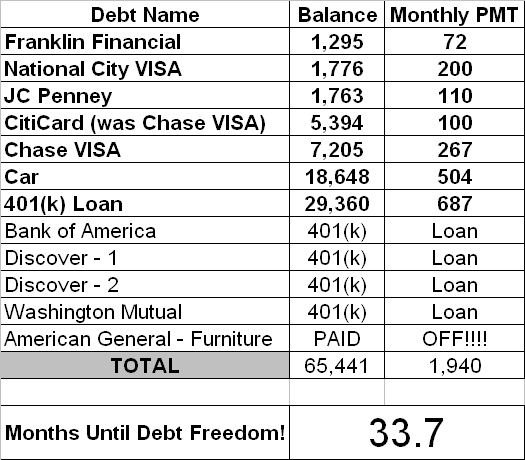

This couple has been married for many years and have one child. They have HAD IT with their debt and have been marching toward debt freedom since November 2007. They are THROUGH with credit cards.

What went well this month?

The 401(k) loan payment won't be taken out of the paycheck until July 1, so we were able to increase our payment to $200 on National City this month! YEAH!! We are hoping once the loan payment comes out we can continue doing this……. It is nice to see some balances coming down…..

What were the challenges/struggles this month?

We are just trying to stay on track and see the big picture at the end…BECOMING DEBT FREE!!! The cost of gas and groceries going up is impacting our budget some…but we are shifting things around so that INCOME – OUTGO = EXACTLY ZERO……we couldn't live without the budget sheet!!! It helps us out TREMENDOUSLY!!!!!

Updated Debt Freedom Date …

Month By Month Progress …

![]()

Have you taught any of your friends/family this stuff? If you have, how did it go?

My husband has shared this with several co-workers who were excited about it….he gave them the website JoeSangl.com so that they could learn more about it.

Sangl Says …

Couple #3 is in position to make dramatic debt reduction. Will it happen? Let us watch and see!

Readers …

If you have debt, what steps do you need to take to position yourself to make dramatic improvements to your debt situation? What will it take to make you take those steps?

Read previous Debt Freedom March updates HERE.

HOME GROUP STUDY: I Was Broke. Now I’m Not.

I am FIRED UP to say that the home group study based on my book, I Was Broke. Now I'm Not., is in its final stages. It will be released by the first week of August!

This study has been written specifically for Church Home Groups, Small Groups, and Sunday school classes.

To help launch this study, I have come up with some special deals that can help you get your materials cheaper.

You can learn more and purchase your copies HERE. All items will ship no later than August 7, 2008.

It is my passion to see people accomplish far more than they ever thought possible with their personal finances.

When people are financially free, they are much more likely to go do EXACTLY what they have been put on this earth to do! THAT, my friends, is what this is all about.

I AM FIRED UP!

Marching To Debt Freedom – Couple #1 – Month 10

Introduction

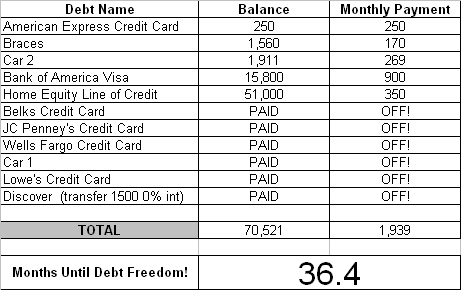

Couple #1 is THROUGH with debt! They have been married for many years and have two children. They are now NINE months into their Debt Freedom March.

What went well this month?

Staying on schedule. I am glad we started this months ago. I would hate to be carrying that extra debt through these tough times.

What were the challenges/struggles this month?

Expenses are taking all the disposable income right now. Food and gas are unbelievable. We are determined not to create new debt. We are being very creative about saying no.

Updated Debt Freedom Date

Month By Month Progress

What has helped you stay on this Debt Freedom March?

The day that I can say I owe no money to anyone will be a benchmark in my life!

Sangl Says …

Next month, Couple #1 will clear $20,000 of debt paid off in the first 11 months of their Debt Freedom March! That is AWESOME! Also, it appears that the American Express card will be ditched completely! This stuff works!

Readers …

How is your own Debt Freedom March progressing?

In my book, I Was Broke. Now I'm Not., I share the story of my Debt Freedom March and teach the exact tools that Jenn and I used to become debt-free. You can do it too! You can read the book's introduction HERE.

SERIES: Negotiate A Pay Raise – Part 5

I write a lot about how to eliminate expenses and reduce the OUTGO from one's home economy, but there is another side to the equation and that is INCOME. INCOME – OUTGO = EXACTLY ZERO works a lot better when the INCOME is increased!

I write a lot about how to eliminate expenses and reduce the OUTGO from one's home economy, but there is another side to the equation and that is INCOME. INCOME – OUTGO = EXACTLY ZERO works a lot better when the INCOME is increased!

This series is focused on one key way that INCOME can be increased and that is to Negotiate A Pay Raise. In each part, I will be sharing how I have successfully negotiated pay raises in the past. I hope this series helps you do the same!

Part 5 – "Negotiation"

Once I received a response from my manager, I took time to compare it to what I requested. If it was everything I asked for (it never was), I obviously would have accepted it. Since my offers were not exactly what I requested, I prepared for a negotiation.

As I entered the negotiation, I knew the following things:

- Which items were the most important to me, and which ones I was OK with leaving alone

- Exactly what I was willing to settle for

- The silent time was over – I was going to leave the meeting with an answer

Negotiations are tricky. Every one has been different for me. I have tried the compromise path. I have tried the "I'm sticking to my guns" and "I refuse to budget" path. The bottom line is that I knew exactly what was needed to call this a successful negotiation for me.

What I do know is that because I had done my homework, I was in a strong position to negotiate and that resulted in a successful pay raise each time. One of them was immediate and another took six months to be implemented. Both were worth it.

So this concludes the "Negotiate A Pay Raise" series on JosephSangl.com. If you are going to make the big ask, good luck and let me know how it goes!

Readers: I know that there are several business managers reading this site. Would you share your thoughts about this series from an employer's/manager's perspective?