Investing

How Much Money Do You Need To Retire Well

Do you know how much money you will need to retire well (independent of Social Security)?

There are many ways to calculate an estimate, but I really like the Retirement Nest-Egg Required calculator that we have placed in the FREE TOOLS section.

To calculate your number, you will need to know two numbers:

- The annual amount you want to live on at retirement (in today’s dollars)

- The number of years until you retire

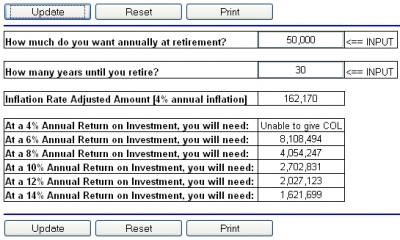

Suppose one wants $50,000/year (today’s dollars) during retirement and plans to retire in thirty years. Punch the numbers into the Retirement Nest-Egg Required calculator and this is what you will see:

Because inflation erodes the spending power of money, the annual amount we want must be adjusted. Using an assumed inflation rate of 4%, one will need $162,170/year in thirty years to have the same spending power of $50,000 today.

At different rates of return, you can see different amounts that need to be saved. Eight percent is a common rate of return on investment that financial planners use.

What is your number? Are you going to achieve it?

Investing – FUN with mutual FUNds

Anyone who reads this blog with regularity knows that one of the key reasons I want you to become debt-free is so you can invest more! Investing means that Jenn and I will be able to achieve many of our hopes and dreams! It means that our current sacrifice will allow us to purchase financial freedom for our future! (Perhaps the number of “!” indicates my level of excitement about this!!!

Well, one of the most common questions I receive is “What mutual funds do you recommend?”

My answer is always, “I don’t recommend mutual funds. I can only tell you what ones I own. What you choose is up to you.”

So today, for those inquring minds who want to know, I am publishing some of the mutual funds/investments that I own.

As I prepared this list, I realized several things:

- We have too many accounts. We have a rollover 401(k), rollover 403(b), 529, Roth IRA, 401(k), and a SIMPLE IRA.

- I am OK with some risk, but for some reason or other I have purchased some bond funds. Maybe that is part of my inner-security needs bleeding out … ?

- I can’t tell you exactly why I own all of these funds – that CAN’T be good. I really hold to the belief that I should not own anything that I can’t tell you exactly why I own them.

Do you have any funds that you really like that you think I should be considering?

Looking for additional Personal Finance Resources? You can obtain free tools by clicking HERE and purchase books/materials by clicking HERE.

Another New Tool: The Investment Value Calculator

www.JosephSangl.com announces another tool to help you on your path to financial freedom!

It is "The Investment Value Calculator".

As you can see below, it could not be any easier! Type in an "Annual Rate of Return", "Time Period", "Current Value", and "Monthly Contribution", and it will provide you with the "Investment Value"! Even better, it will also return a snapshot of the value of such an investment in 5 year increments!

You can access this new tool by clicking the "TOOLS" link at the top of the page or by clicking HERE!

Happy calculating!!!

Make money by fixing up a house & selling it

If you have been paying attention at all to the finance world, you know that it is important to have a diversified portfolio.

You do not want to have all of your eggs in one basket – such as having a majority of your money invested into a single stock.

Well, I believe that I have a well-diversified portfolio through a variety of mutual funds. The issue is that all of these investments are impacted by global/world/regional events that may or may not have anything to do with the mutual funds I own.

This is why I own a house. It is an investment that helps my financial portfolio become more diversified.

I have owned quite a few homes, but the home I now own is the first older home I have purchased. This house was in some dire need of structural improvements AND decorative updates.

However, I bought this house at a discount because of all of the issues with it. It was NOT move-in ready.

Here is a list of problems that it has/had:

- Dog pee all over the carpets

- Dog damage from climbing on window sills, digging up the yard

- Rotten floor

- Leaking roof – several spots

- Sagging roof

- Old appliances

- Wood paneling with horrible wallpaper all over it

- Leak damage on the walls/ceilings

Now, I am the son of a home builder. I know a little bit about working on houses. I will tell you that this is my first attempt at updating a house myself. As a result of this project, I have developed a short tip list for you should you consider doing this.

Tips

- If you have no clue about updating houses – do NOT do it unless you have a pile of green portraits of Ben Franklin that you want to donate to others.

- Have a contigency fund for the problems you will discover as you fix other known problems

- Get help when you get in over your head

- Don't move in to the house until you have fixed the structural issues. It is so much easier to complete a major project when you are not living there!

- Develop a budget for the projects and HOLD TO IT! Be realistic on estimated costs!

- Cry when you need to. It lets some of the frustration and anger out.

In the end, you will have a nice house for a good price and have some good ole sweat equity built up!