Saving

On-Line Banks – Why I Use Them For My Savings Accounts

If you have ever heard me speak or teach about saving money, then you have undoubtedly been introduced to on-line banks. I’m not talking about banks that have websites but about banks that have little to zero physical “bricks & mortar” locations.

I’m talking about banks like Capital One 360 (formerly ING Direct) and Ally Bank (built on the base of GMAC).

Here’s why I use on-line banks (over a local bank) for my savings accounts:

- Better interest rate On-line banks pay interest that is generally 5 to 8 times more than a local bank savings account (somewhere near that of a 2 to 3 year CD) – but it doesn’t affect the liquidity of my money

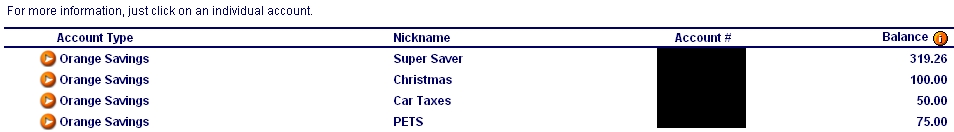

- Sub-Accounts If you have a regular savings account, all you can see is a total amount of the money the account currently contains. With on-line banks, you can create something called “buckets” or “sub-accounts” to give every dollar a designated name! This means you can create sub-accounts like “Christmas”, “Emergency Savings”, “Vacation”, “Life Insurance”, etc. See the example screen shot below from my Capital One 360 account. You can click the image to see a larger version. This makes it so much better!

- Automatic SavingsYou can establish automatic transfers from another existing bank account. In the example I show below, I have set up automatic transfers for my emergency fund, YMCA annual membership, House taxes and insurance, Christmas, and life insurance premiums. It is a “set it and forget it” approach to savings that is awesome!

- Customer Service Because these banks only have an on-line presence, they have to be INCREDIBLE at customer service, or people would not even know about them. Every interaction I have had with my on-line banks has been an incredibly positive experience.

- FDIC-insured These banks are insured by the FDIC – just like any other bank. That means your deposits are protected. I like that!

- No fees There are no fees unless you exceed the monthly allowable transactions (or something extraordinary like that)

- No MINIMUM balance This makes it perfect for any and every saver.

I encourage you to check them out: Capital One 360 and Ally Bank.

Set a savings goal. Then establish an automatic savings plan to help you accomplish it!

Do you use any of these banks? What do you like about them most?

Budgeting And Saving Tips

Looking for ways to save money? Here are a few that can help!

- Coupons.com has a lot of great coupons that you can print out

- MyCoupons.com has a lot of great information on deals that are being found at various stores

- Buy off-brand items. Yes, some will taste like sawdust, but others are identical to the name brand. If you have an ALDI grocery store in your area, it is worth the drive to purchase groceries there. We save at least $50 a month by buying our essentials there – milk, bread, canned foods, eggs, etc. As a side note, their eggs can be somewhat non-uniform – I get double-yolk eggs, oblong eggs, and wobbly eggs. It is really interesting.

- Skip the grocery store for one week. Put together meals from stuff that is in the cupboards and freezer! You will enjoy some concoctions you have not had in awhile (or never), AND you will be able to save a week’s worth of grocery money to put toward your emergency fund!

- Have the kids mow the lawn and maintain landscaping instead of paying someone else to do it. Pay your kids and teach them how to save, give, and spend their money! Can you spell, “LEARNING OPPORTUNITY?”

- Cut your kid’s hair. This will save many families $20 – $40 per month!

- Visit consignment stores, Goodwill, or Salvation Army Thrift Stores. You can find some great deals on clothing!

- Shop your insurance for quotes (US Insurance Online). Get at least three quotes and obtain one of them from an independent insurance agent. You may be able to save $100 – $500/year on your insurance!

- Take a low-budget vacation instead of a $3,000 one. Using creative options, you will discover just as much fun, and you may be able to save $2,000 – $2,500 which can then be used for debt reduction, emergency fund, or retirement fund!

- Wait one day before making a major purchase decision. This will really help you to avoid “impulse” purchases like a new car, a pricey vacation, a new plasma TV, etc.

- Eliminate the home telephone. So many people have cell phones that the home phone has become virtually obsolete. For basic home telephone service you will pay $25/month, and it will not come with basic features of a cell phone such as free long distance, caller-id, call waiting, voice mail, camera, text messaging, games, etc. If you need a basic phone for emergencies, I like the MagicJack.

- Get rid of the movie channels on cable.

I would love to hear more ideas on how you can save money!

Accountability

In school, if you did not pay attention in class and did not study the subject matter, you would receive an undesirable letter grade. It would be the dreaded one-legged “A” – also known as a big ole “F”.

I don’t know what would have happened in your family, but if would have ever brought home a “F” on my report card, I am pretty sure that I would have become the first person who achieved near-earth orbit via an explosion from my parents.

This is an example of near-instantaneous feedback. If I choose not to study, it would take no more than a few months later to receive the dreaded “F” and ultimate accountability with my parents.

It is NO DIFFERENT with your finances! You might think that you are getting away without studying the subject. You might have convinced yourself that you do not really need to take time to plan your finances. You could even believe that you are doing well enough without learning more about finances.

I will tell you that you are dead wrong.

If you do not learn about the subject of your personal finances, you WILL have accountability.

It will come in the form of:

- Not being able to pay for your children’s wedding

- Not being able to pay for your children’s college

- Not being able to retire

- Not being able to take that vacation that the rest of your friends/family are taking because you are broke

- Daily FINANCIAL STRESS that just will not go away

- Questions from your children on why you and your spouse are always arguing about money

- Having to work tons of overtime just to pay the bills

- Having to take a second job just to pay the bills

- Not being able to be a stay-at-home mother because bills have forced you into the workplace

- Not being able to start that business you always wanted to start

- Not being able to realize a lifelong dream to travel around the world

I do not know if any of these have hit home with you, but I made a decision long ago that I would NOT allow money to dictate what I do and do not do. I will take the money that I have and tell every single George Washington where to go. I will ensure that quite a number of George’s are given away and that large quantities are saved BEFORE I start spending them on anything else.

My PRIORITY is to get an “A” on my finances. The only way I will accomplish this is to continue learning and applying what I learn to my finances.

Every. Single. Day.

Looking for financial accountability? The I Was Broke. Now I’m Not. Group Study is the perfect tool to learn about winning with money in a setting where accountability is created. Click HERE to get your group started or learn more.

Known, Upcoming, Expenses – Capital One 360 Sub-Account Tracking

//This blog post was written by Joe Ziska – I loved this idea so much that I personally implemented it with my Capital One 360 accounts!//

Q) What two things do the following have in common?

Christmas; A flat tire; Your son going to college; Vacation in Hawaii; Your daughter getting married

A) 1. They all cost money. 2. We forget that they cost money until the bill comes!

Let’s face it. Even the most organized of us tend to forget things now and then. Whether misplaced car keys or forgotten reservations for Valentines Day, our imperfect memories always seem to make life more difficult. In my experience, forgetting large upcoming expenses is one of the most demoralizing things that can happen to you. Unlike true emergencies, such as a sudden illness or job loss, known upcoming non-monthly expenses (KUEs) such as these listed above, can and should be expected! As Joe always asks, “Should it be a surprise if your car breaks down?” Of course not. That’s what cars do!

Many of you reading Joe’s blog are trying desperately to get out of debt and gain financial freedom. For my wife and me, one of the most disheartening things in that process was a big expense wiping out our emergency fund. Just when we felt we were finally getting traction, a $500 car repair or having to pay for Christmas presents would knock us off course. We constantly felt like we were starting over. I knew that we should be saving for these expenses but didn’t have a good way to separate this from our emergency fund. We’d generally leave a decent balance in our checking account and just hope that it would absorb most of these expenses when they came up.

I wanted to save for these KUEs. However, the mathematical part of me rebelled at the idea of gaining no interest on our savings (especially as some of these expenses can be quite costly). Wouldn’t it be better to just pay down some debt or invest the money?

Enter Capital One 360. I’d been using HSBC and Capital One 360 to earn good interest on money we were saving for a down payment for our house. However, it wasn’t until almost a year after opening our accounts that I realized how they could help with my KUE problem.

One day, I was checking my account balance online and I noticed a large button labeled “Open an Account”. I figured this was used for investing or to open a new CD but clicked on it anyway. After browsing for about 30 seconds, I realized that Capital One 360 will let you create numerous new savings accounts linked to your original account. Not only that, you can give each a unique name to help you identify them. We created categories for all of our Known Upcoming Expenses to keep them separate from actual emergencies. Below is an example screenshot from an account (click on it to see it better):

We have also set up automatic transactions to each individual account. So now, at the beginning of every month we move $12 to our pet fund (unfortunately, our dog doesn’t pay her own vet bills), $40 to our Christmas fund, and so on. When we need the money for these expenses, it takes only 3-4 days to move it back to our primary checking account. Meanwhile we’ve been earning interest on our money instead of paying interest to a credit card company when these events sneak up on us. Last time I checked, Christmas is still in December so you’ve got 5 months to save up for all those gifts. Why not create an account for it and make it automatic?

========= End of Guest Post by Joe Ziska ===========

Thanks for the article, Joe!

Strategies For Saving Money

One of the largest issues I see during our one-on-one financial coaching meetings is the inability to save money.

Here are some facts about saved money:

- Saving money is essential to long-term sustainability

- Saved money relieves stress

- Saved money allows you to take a chance

- Saved money allows life to happen (job loss, disability, pay cut, injury, etc.) without going broke!

But you already knew that part. We all know that we are supposed to “save money for a rainy day.” Yet, even though we KNOW how important it is to save money, most people fail to do so.

My hope with this blog post is to challenge YOU to take a next step. If you have negative savings (no money plus overdrafted accounts and debt), the goal is to bring you to zero. If you are at zero savings, the goal is to get to at least $2,500 in a beginner emergency fund. If you have been able to save a substantial amount of money, it is my hope that you will participate in the discussion and share your own tips that have worked well for you.

Automatic Draft From Paycheck

Establish a savings account and have the money drafted from every single paycheck. Whether it is $25 or $250 per pay period – just SAVE! You KNOW that the car is going to break down. You KNOW that the school is going to send home a surprise expense.

By establishing this draft, it allows the money to be “out-of-sight.” When money is out-of-sight, it can be out-of-mind. This allows the account to grow without you robbing it!

Now, I personally had a problem with this when I did not have a monthly budget. I would ROB my own savings account about 2.1 microseconds after I was paid. Only after I had a plan developed together with my bride, Jenn, did my savings account begin growing in a healthy manner.

Create An Escrow Account For Known, Upcoming Expenses

For those unfamiliar with an escrow account, it is a savings account that is established by a mortgage company. The mortgage company totals the annual cost of property taxes and homeowner’s insurance and divides it by the number of payments being made each year. The mortgage company then pays for the taxes and insurance from this escrow (savings) account. For example, if the property taxes are $1,200/year and the insurance is $600, then the total amount needed each year is $1,800. The mortgage company will collect $150 extra with each monthly payment to place into the escrow account.

An escrow account smooths out the cost over a year – instead of having to pay for it all in one month. It tightens the monthly budget, but having a fully funded escrow account sure is AWESOME when vacation arrives and the money has already been saved to pay cash for it! Those who have a mortgage with an escrow account will testify to the fact that they never worry about paying for the taxes and insurance – ask someone!

Take a moment to read THIS POST about how to calculate the amount you need to save each month for your known, upcoming expenses.

Take it from one who has lived it – if you do not plan for your known, upcoming expenses, your ability to save money will be tremendously hampered!

How about you? What are some ways you have made saving money easier in your own finances?

NOTE: I hold my Known Upcoming Non-Monthly Savings in an account at Capital One 360. It allows me to save money “out of sight – out of mind” and allows me to create “sub-accounts” for each item I am saving for. For example, I have created a “Christmas” and “Car Replacement Fund” in my account. You can check out Capital One 360 HERE.