Tools

CNN Money 101 Classes

One of my core values is to CONTINUALLY LEARN. About finances. About gardening. About leadership. About being a husband and dad. I love learning. LOVE IT!

In all of my classes, I tell everyone that my class is NOT the "be-all, end-all, teach-you-everything-about-finances" class. Because money affects nearly every aspect of our lives, it is so crucial to continue learning about money.

A good place to further one's learning about money is at CNNMoney.com's Money 101 site. They have a 23-lesson class put together that is easy to understand and well put together. Check it out HERE.

Receive each post automatically in your E-MAIL by clicking HERE

Known, Upcoming Expenses – Sub Account Tracking

The below was written by Joe Ziska. Joe and his bride have helped with the Financial Freedom Experience multiple times and are ON THE CRUSADE for financial freedom! Joe offers another way to keep a name on each dollar saved for known, upcoming expenses. I like it!

Q) What two things do the following have in common?

Christmas; A flat tire; Your son going to college; Vacation in Hawaii; Your daughter getting married

A) 1. They all cost money. 2. We forget that they cost money until the bill comes!

Let’s face it. Even the most organized of us tend to forget things now and then. Whether misplaced car keys or forgotten reservations for Valentines Day, our imperfect memories always seem to make life more difficult. In my experience, forgetting large upcoming expenses is one of the most demoralizing things that can happen to you. Unlike true emergencies, such as a sudden illness or job loss, known upcoming expenses (KUEs) such as these listed above, can and should be expected! As Joe always asks, “Should it be a surprise if your car breaks down?” Of course not. That’s what cars do!

Many of you reading Joe’s blog are trying desperately to get out of debt and gain financial freedom. For my wife and me, one of the most disheartening things in that process was a big expense wiping out our emergency fund. Just when we felt we were finally getting traction, a $500 car repair or having to pay for Christmas presents would knock us off course. We constantly felt like we were starting over. I knew that we should be saving for these expenses but didn’t have a good way to separate this from our emergency fund. We’d generally leave a decent balance in our checking account and just hope that it would absorb most of these expenses when they came up.

I wanted to save for these KUEs. However, the mathematical part of me rebelled at the idea of gaining no interest on our savings (especially as some of these expenses can be quite costly). Wouldnʼt it be better to just pay down some debt or invest the money?

Enter Capital One 360. I’d been using HSBC and ING Direct to earn good interest on money we were saving for a down payment for our house. However, it wasn’t until almost a year after opening our accounts that I realized how they could help with my KUE problem.

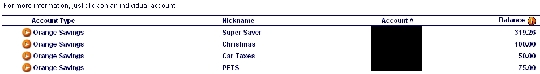

One day, I was checking my account balance online and I noticed a large button labeled “Open an Account”. I figured this was used for investing or to open a new CD but clicked on it anyway. After browsing for about 30 seconds, I realized that Capital One 360 will let you create numerous new savings accounts linked to your original account. Not only that, you can give each a unique name to help you identify them. We created categories for all of our Known Upcoming Expenses to keep them separate from actual emergencies. Below is an example screenshot from an account (click on it to see it better):

We have also set up automatic transactions to each individual account. So now, at the beginning of every month we move $12 to our pet fund (unfortunately, our dog doesn’t pay her own vet bills), $40 to our Christmas fund, and so on. When we need the money for these expenses, it takes only 3-4 days to move it back to our primary checking account. Meanwhile we’ve been earning interest on our money instead of paying interest to a credit card company when these events sneak up on us. Last time I checked, Christmas is still in December so you’ve got 10 months to save up for all those gifts. Why not create a Capital One 360 savings account for it and make it automatic?

Thanks for the article, Joe!

Receive each post automatically in your E-MAIL by clicking HERE

Purchase my book on AMAZON.COM or via PAYPAL.

What Is This Money For? A New TOOL!

Have you ever looked at your checking and savings account and wondered aloud – "What is this money for?"

I used to do this all of the time.

For example, I would look at a checking account and see $5,000 there. Now, seeing $5,000 was a good thing, but I could not keep track of what I was going to use that money for.

Today, I am proud to introduce a greatly improved "[download#8#nohits]" tool!

Here is how it works. Let's say that you are saving for the following items.

- Emergency Fund

- Christmas

- Property Taxes

- Annual Car Insurance Premium

- Life Insurance

- Vacation

And, let's say that the money is being saved in three different accounts – a Christmas Club, Savings, and Checking Account. The "[download#8#nohits]" tool helps you keep track! There is $1,000 in Checking, $5,000 in Saving, and $200 in the Christmas Club account.

![]()

What is the $6,200 in the accounts for? Using the [download#8#nohits] tool, you can clearly give a name for every dollar you have!

![]()

When the total amount saved matches the total amount named, the BALANCED? section turns green with a "YES"!

If not all of the money has been given a name, the BALANCED? section turns yellow with a "LOW".

![]()

If too much money has been given a name, the BALANCED? section turns red with a "HIGH".

![]()

Here is what it will look like when it is balanced!

![]()

One huge benefit of having your savings account completely named is that you AND your spouse will KNOW what the money is for. It eliminates disputes (yes – this is what the money was for), it provides encouragement (yes – we get to take vacation), and it makes sure the necessities get paid.

Try it out! – [download#8#nohits]

Receive each post automatically in your E-MAIL by clicking HERE

Purchase my book on AMAZON.COM or via PAYPAL.

Net Worth – How do you stack up?

New Tool! Announcing the Time Budget

In November 2006, I wrote about the power of budgeting your time! It works the same as budgeting your money!

Similarities between money and time.

- You have limited income AND time.

- You can only spend a dollar AND an hour once and then it is gone!

- Planned money and planned time goes farther and is less susceptible to waste.

- Both money and time are valuable!

I have now added two new Time Budgets to the TOOLS page.

One Time Budget is in 1/2-hour increments and the other is in 1-hour increments.

How are you spending your time? Are you accomplishing everything you hoped for? I highly recommend a time budget – especially for ensuring that the family spends a lot of time together. The Sangl's have used the time budget to ensure that "Family Game Nights" and "Daddy-Daughter Date Nights" are on the schedule. You don't want to miss out on these, and a time budget is a great to way to ensure that they happen regularly!

Have fun!