THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

Ways To Save Money

My team has been working on a page on our Next Steps site to provide practical ways that people can save money on common items that people purchase. We want your ideas! For example, what are some ways you have saved money on: Groceries Internet Cable TV Cell phone service Car insurance Purchasing a new…

Read MoreHow Healthy Are Your Finances?

I saw that title on an article link at CNNMoney's personal finance website, so I clicked on it. The link leads to a great tool that helps you evaluate your current financial condition – then it gives you a report card grade. Check it out HERE. Read recent posts

Read MoreRule Of 72

Have you ever heard about the "Rule of 72"? It is utilized to quickly provide a rough calculation of how long it will take your investment to double. You need to know three things to use the "Rule of 72": The annual growth rate of the investment The current amount of money invested The amount…

Read MoreFun Things To Do For FREE (or close to it)

In a tight economic time, a lot of people are getting very creative about how they spend their time and money. Let's face it, we all want to have fun – even more so when the money is tight and times are stressful! Here are some ways that I have seen people having fun and…

Read MoreSERIES: Top 5 Things People Lack In Their Financial Plan RECAP

So that's it for the Top 5 Things People Lack In Their Financial Plan series! I hope that it has been a help for you. Below is a recap of the Top 5 Things (plus the Bonus one). A monthly written spending plan A plan to get out of debt A written will Term life…

Read MoreSERIES: Top 5 Things People Lack In Their Financial Plan BONUS

Over the past two and a half years, this crusade has been able to reach tens of thousands of people. I was recently reflecting on the top things that I see most commonly lacking in folks' financial plans. So here are the top five things I see lacking. BONUS for self-employed Health Insurance I know…

Read MoreAbout Joe

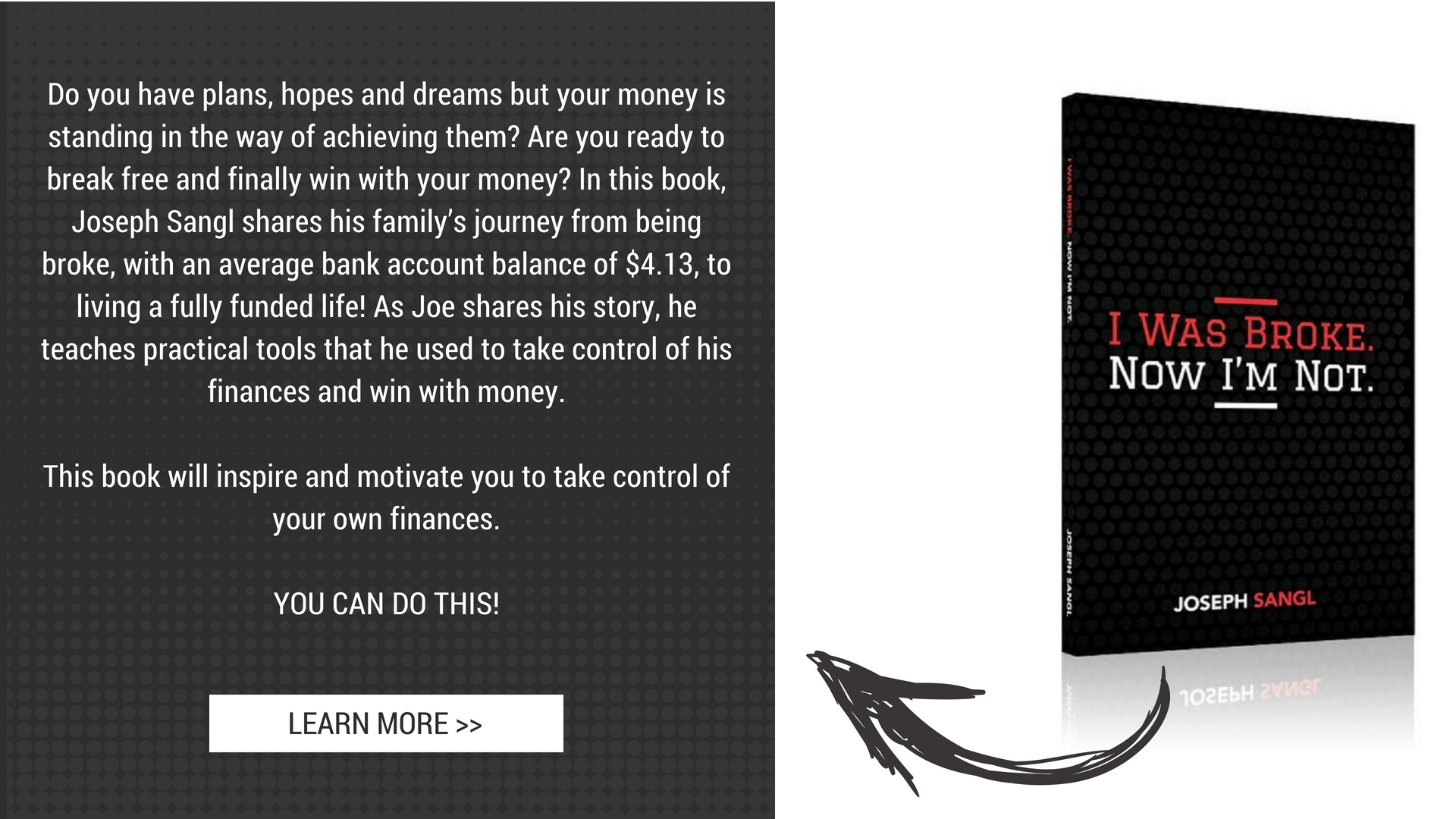

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.