THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

Get Your Finances Organized!

It is extremely important to have your finances organized. In fact, I believe that lack of organization is one of the top reasons that people do not reach the peak of their financial potential. I am excited about this post, especially because we have a FREE tool to help! Some of you may…

Read More5 Ways to Save Money Without Selling Anything

When the economy takes a down turn, one of the best ways to “weather the storm” is to save money! In this post I will share the top five ways that we see people saving lots of money. I believe that if you apply these five items, you will save over $1,000 a year. Don’t…

Read MoreYou Can Be Debt-Free

I have found that a vast majority of those who sign up to attend the Financial Learning Experience are living paycheck-to-paycheck AND carrying debt. In fact, statistics from surveys I have conducted show that 72% of those attending my classes are living paycheck-to-paycheck. Of those 72% living paycheck-to-paycheck, 24% are BEHIND on payments. Only 3%…

Read MoreWhat Should I Do With My Tax Refund?

What are you going to do with your tax refund? While tax season may seem like a distance memory to some, others may been filing today. 2020 has brought about a lot of changes, one of which was an extension for tax filing from April 15th to July 15th. If you’re getting a refund what…

Read MoreHow Do I Stop Impulsive Spending?

Recently, I was teaching the Financial Learning Experience at my local church when I had a gentleman raise his hand and asked this question. “How Do I Stop Being Impulsive?” My answer? I don’t know to stop the impulsive nature, but I DO know how to control my impulse to spend recklessly. I am a SPENDER. …

Read MoreBudgeting When You Have Irregular Income

Do you have irregular income? Maybe it is seasonal or cyclical. There is a large group of folks whose family economy is powered by irregular income. Real estate agents, hair stylists, commissioned salesmen, and business owners all experience seasonal or cyclical income. Folks who live with this type of income often tell me that…

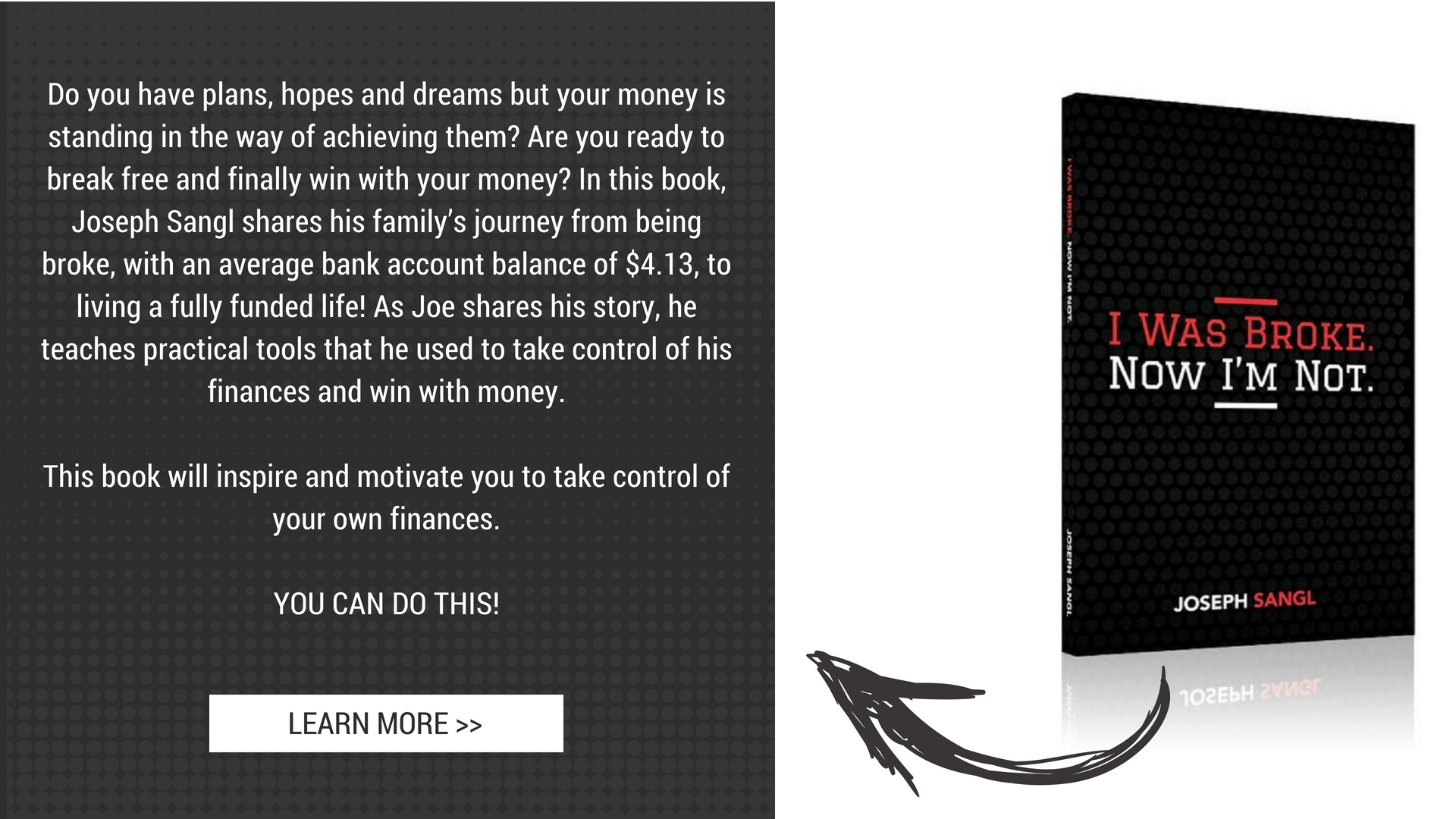

Read MoreAbout Joe

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.