THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

I Lost My Job – Now What?

In a time of increasing unemployment and job loss, I thought it might be helpful to write this post. It is my hope that it is a help to those who have experienced a job loss. Step One – Prioritize. Prioritize. Prioritize. When you lose your job and paycheck, all expenses must immediately be prioritized.…

Read MoreHow Do I Budget?

Budget. The word alone sends chills to many people. Here are some things that people equate with budgets. Budget = Restricting Budget = I Am Broke Budget = Controlling Budget = No Fun Budget = Constricting Budget = Not going to do it! Most people have tried budgets … and failed! It was a bad…

Read More“I can’t pay my bills!” How many of you have said this recently? Have you heard friend or family member say this? Unemployment rates a skyrocketing, more lay offs are being announced daily, and pay cuts are now seemingly common. Many people are finding themselves in a situation where they can’t pay their bills. Before…

Read MoreShould I Have a Credit Card?

Should you have a credit card? Some people say “yes,” while others are completely against them. So, what are you supposed to do? On today’s episode of the Monday Money Tip Podcast, we’re discussing the pros and cons of each side. If you have questions about credit cards, make sure to check out this episode.…

Read More“No” Allows You to Say, “Yes”

Happy Monday Everyone! Another episode of the Monday Money Tip Podcast is LIVE! Do you find it challenging to follow a budget because you feel like you’re constantly having to say, “No!” to yourself – and the rest of your family? On today’s episode, we’re addressing this feeling and how saying “no” now can help…

Read MoreMarch 2020 Update From I Was Broke. Now I’m Not.

Do your finances cause you frustration, fear, and anxiety? Discover how you can handle financial anxiety and become more comfortable dealing with money. **CLICK HERE TO LEARN HOW TO DEAL WITH FINANCIAL ANXIETY DEBT!!! Is it all equal? Are there different kinds of debt? What type of debt should you avoid, and is there any debt…

Read MoreAbout Joe

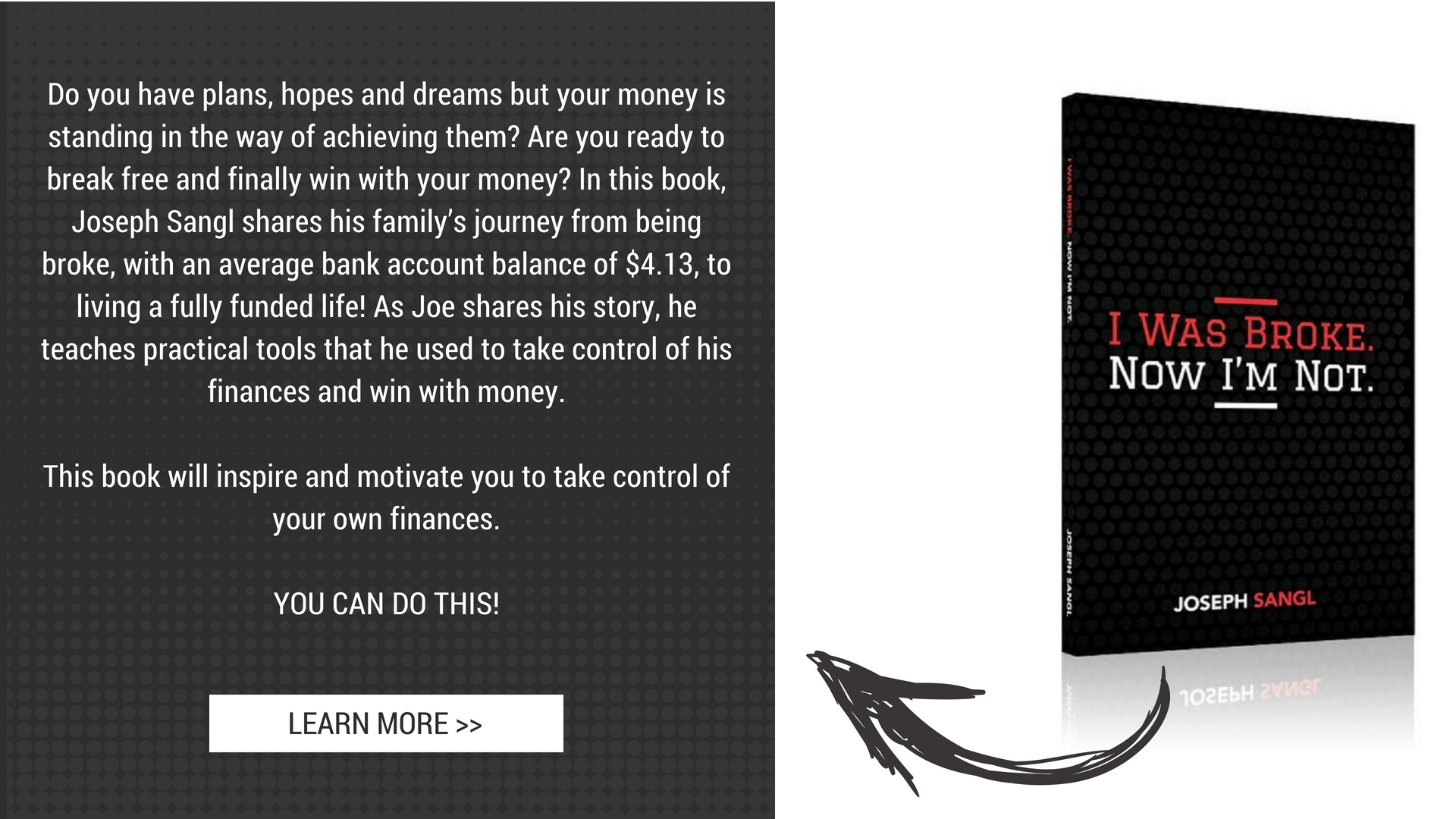

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.