Tools

Money Lies – I Can’t Budget

There are tons of excuses for why you should not budget. It is hard, it can be time consuming, and you might not feel like you make enough to budget. I get it. But if you have been believing any of these excuses and use it as a reason why you cannot budget, you are believing a lie! I am not going to lie to you, budgeting can be challenging. If it were easy, people would not feel so intimidated by it.

Ultimately, budgeting or not budgeting is a choice. There is not a situation that prevents you from completing a budget. You either choose that you are going to win with your money or you choose to let your money run you. I know which option I am choosing. A budget allowed me to do so much more than I ever thought possible in terms of my finances. A budget set me free.

- A budget allows me to know where every single dollar is going BEFORE I am ever paid.

- A budget provides me choices – because I plan it before I receive it.

- A budget allows my bride and I to have constructive conversations every single month about our plans, hopes and dreams.

- A budget allowed me to pay off all of my non-house debt in just 14 months.

- A budget allowed me to pay off my house in 10 years and 1 month.

- A budget allowed me to send my daughter off to college without incurring any student loans, fulfilling a dream of mine.

You can come up with as many reasons as you would like to not budget. But, there are so many more reasons that you need one! It will set you free and allow you to do more than you ever thought possible, just as it did for me.

Try some of these practical ways to make a budget work well for you:

- Use a budget tool – Budget tools will do the math for you. This keeps you focused on the financial decisions at hand instead of facing a terrible math quiz. You can try our FREE BUDGET TOOLS HERE and they will do all the work for you!

- Build an emergency fund equal to a full month of EXPENSES – Notice I said expenses, not a full month of your income. Once you have saved enough for an entire month of expenses, you can ignore multiple paychecks and use the Monthly Budgeting Tool instead. And, you will rid yourself of a level of stress that you may not have even known you had!

- Be realistic – If you are just beginning to prepare a monthly budget, it is important to be realistic about your expenses. Do not tell yourself that you will spend $3.45 on groceries in the next month. That is not possible and you will fail if you structure your budget this way. If you have a household of kids that are involved in 62 after-school activities, do not put $0 in your dining out budget. Go through your debit/credit card history and see what your spending habits are. Once you have determined what your history is, you can trim to what is reasonable.

Remember, no matter how daunting of a task you think budgeting is, it is going to beat not budgeting 10 out of 10 times. Do it. You need it.

==============================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

Are you struggling with your budget? Are you ready to take control and finally start winning with your money? If so, join our first ever I Was Broke. Now I’m Not. 40 Day Budget Challenge. During this challenge we will help you create a budget and give helpful and practical tips every single day to make sure that you follow through until the end of the month. Our launch date is Tuesday, August 21st and you can REGISTER HERE. Don’t miss out!

Mini Budget Tool – Plan your back to school spending!

Can you believe it is already August?!! Summer has flown by and school is right around the corner. With classes starting up, inevitably you will be getting a list of required school supplies that your child will need for the first day of school. You planned for that in your budget, right?

You should have set aside some money for school supplies and new clothes but the Mini-Budget Tool can help you take that planning one step further, especially if you have multiple kids!

You can use the tool to show different scenarios for spending different amounts on various items. Get your list(s) together and make a plan for your back-to-school shopping. This way, you are way less likely to overspend and blow your August budget.

Remember, when your INCOME – OUTGO = EXACTLY ZERO, the cell will turn green, indicating that you have “spent” every dollar on paper first. You will notice after you download the tool, there are three different options for your budget. This gives you the option to spend your money multiple ways and see which allocation of money makes the most sense for you.

Try out the mini-budget tool today and plan your back to school shopping today!

EXTRA TIP: Make sure you check to see if your state participates in Tax Free Weekend and plan your school shopping then! This can be really helpful in saving some money, especially if you are looking to buy big ticket items such as a new laptop!

========================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

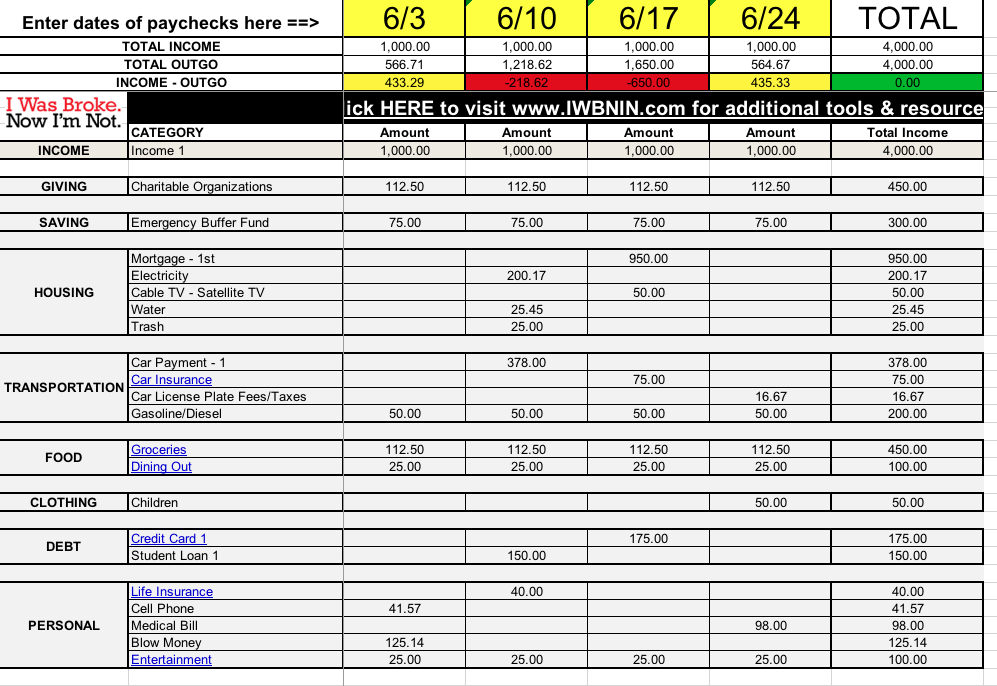

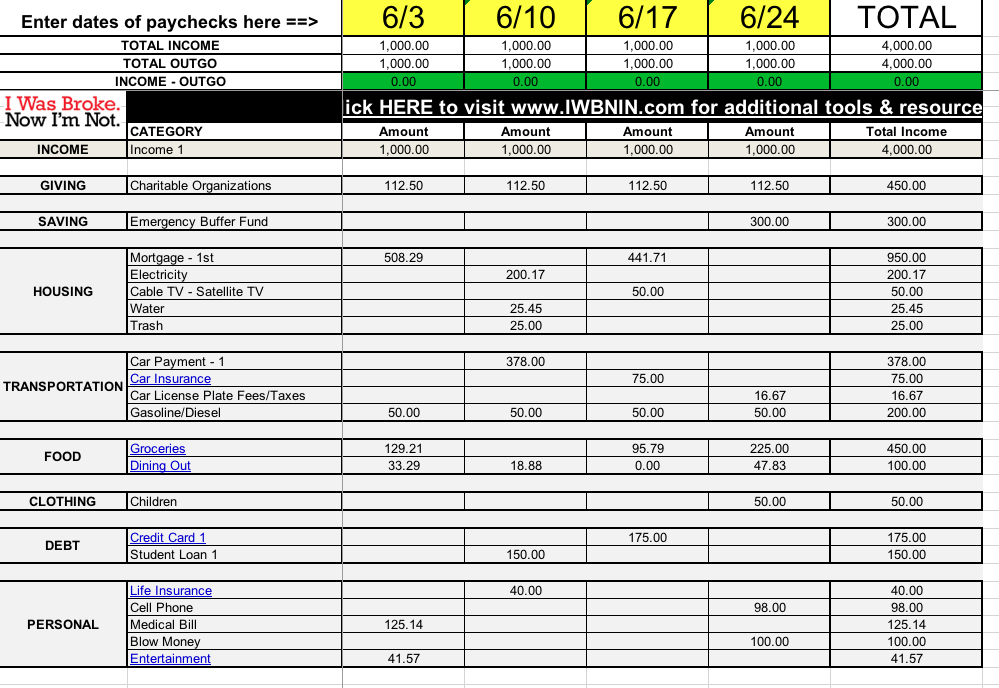

Weekly Budget Tool

I have found that monthly budgeting is by far the simplest way to budget but that many people are unable to sit down and pay all of their bills at one time and be done with it. For most people, they must perform a delicate balancing act when paying their bills using each paycheck to pay certain bills. For many couples that are paid twice a month, one of the pay periods is a period of “feast” and the other pay period is a period of “famine.” A budget will resolve this issue!

Assume you are paid $1,000 per week take-home pay and you do not have enough money in the bank to pay all of your bills at once. You must balance your spending to align with the arrival with each paycheck. Using the Monthly Budget by Week tool, you can assign your planned expenses to pay periods in a way that allows each bill to be paid on time or early.

Now, you can see that your budget balances overall, but each week does not equal Exactly Zero (EZ). Because you are planning before the month begins, you can work to develop an EZ budget for each paycheck. Look for areas where expenses can be moved from their overspent paychecks to those that are underspent.

This will look differently depending on when each of your bills are due but as long as your income is enough to cover all of your bills, it will work.

Now you have an EZ Budget for every paycheck! All payments will be made on time and every single financial obligation has been met!

The beauty of this tool is that it puts you back in control! You might be thinking it is completely crazy to skip a week of grocery shopping. But you can easily go one week without purchasing groceries by using the food in your pantry and freezer. And you have a week to prepare for the week with no grocery money. Because you have planned before the month begins, you can identify any financial challenges before they happen.

This is the beauty of the budgeting process. You are able to manage your money instead of feeling like your money is managing you. You are telling your money where to go instead of wondering where it went!

=======================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

SPECIAL OFFER: Weekly budgeting can be confusing. Luckily for you, Joe has written an entire chapter dedicated to Weekly Budgeting in his book I Was Broke. Now I’m Not. This month only, get your own copy for 25% off plus free shipping! Get your copy HERE before July 31st!

“I can promise that if you read and apply what has been written here then you will eliminate financial regret from your life.” – Joe Sangl

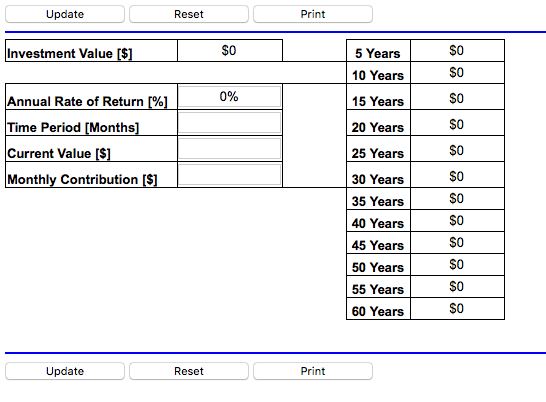

Investment Value Calculator

How much would you be able to save by trimming the fat on your different insurance policies? A couple hundred dollars per month? Now, how much would you have if you took those savings and invested the difference? Insert our Investment Value Calculator tool!

This tool is incredibly easy to use and can be manipulated to show a multitude of scenarios. Simply enter an annual rate of return, the amount of months you would invest the money, the current value of the account, if any, and the amount you will be contributing monthly.

This tool is incredibly easy to use and can be manipulated to show a multitude of scenarios. Simply enter an annual rate of return, the amount of months you would invest the money, the current value of the account, if any, and the amount you will be contributing monthly.

For example, say you have a whole life insurance policy that is costing you $4,000 each year and decide to instead apply for a thirty year term policy that will only cost you $380 each year. That is a difference of $3,620 (about $300 each month) in savings every single year! Yes, you could use this extra money towards a vacation but think long term. Try putting this into the calculator and see what it could be worth down the road.

Not only will this tool allow you to see your Investment Value after the time period you selected, but it also allows you to see the investment value at 5 year increments. Try it out on your life, auto and home insurance policies! Save on your insurance and put your money to work for you today!

Not only will this tool allow you to see your Investment Value after the time period you selected, but it also allows you to see the investment value at 5 year increments. Try it out on your life, auto and home insurance policies! Save on your insurance and put your money to work for you today!

=======================================================================

Want more tips like this one? Subscribe to the Monday Money Tip Podcast HERE.

SPECIAL OFFER: This month only, get your own copy of Joe’s book, I Was Broke. Now I’m Not. for 25% off plus free shipping! Get your copy HERE before July 31st!

“I can promise that if you read and apply what has been written here then you will eliminate financial regret from your life.” – Joe Sangl

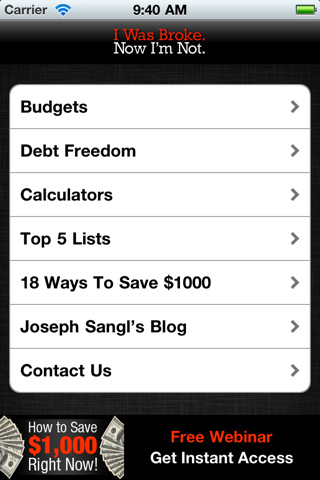

I Was Broke. Now I’m Not. APP

I’m excited to announce that our APP has been updated to include the most requested feature – The ability to sync your budgets across multiple phones/devices!

Our APP is available FREE for all Apple mobile products including iPhone, iPod Touch, and iPad as well as all Android mobile products!

Download the APP now: