THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

Book Release – FIVE days and counting!

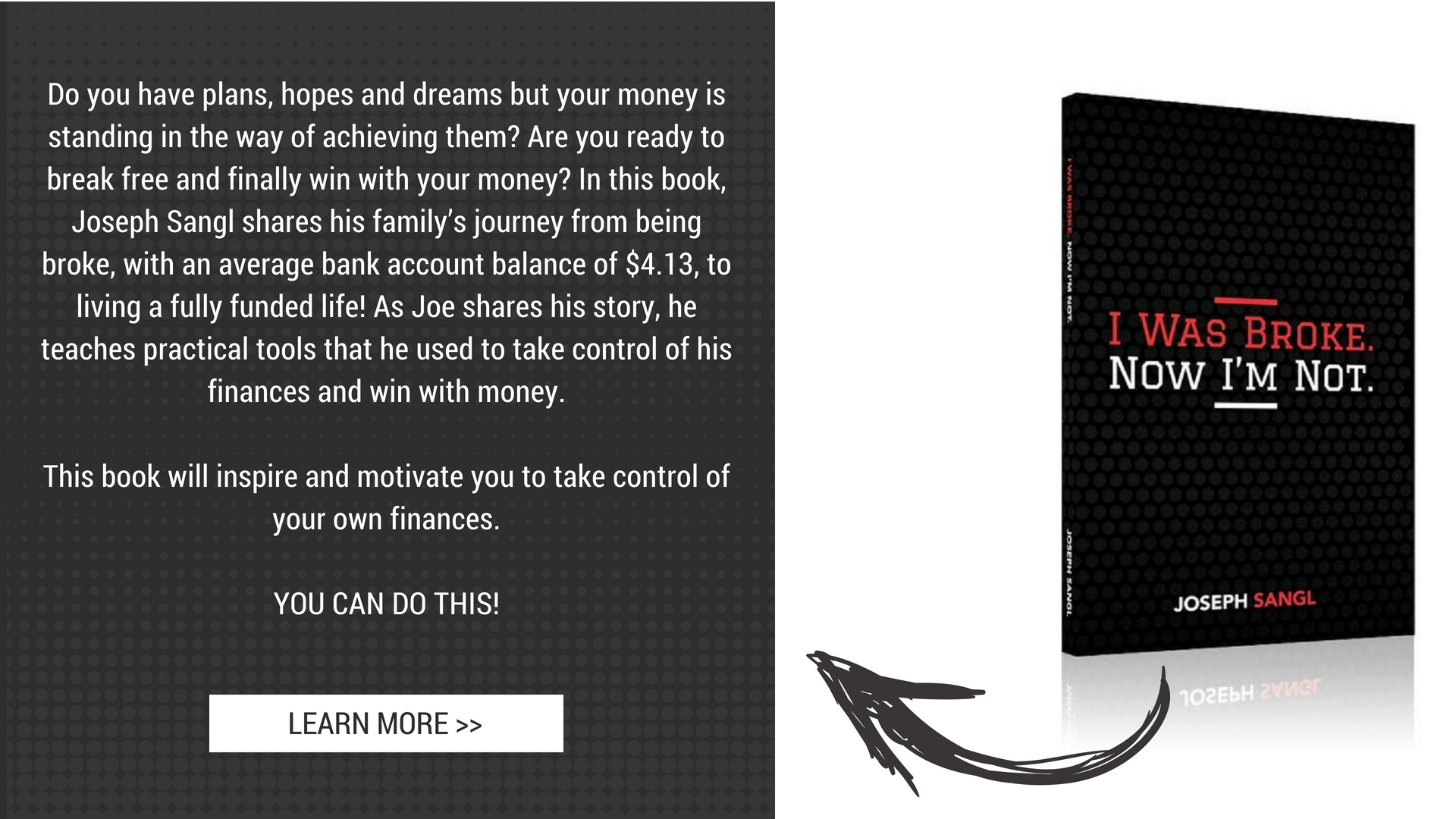

FIVE days and counting until my first book, I Was Broke. Now I'm Not! is released! Read recent posts by Joe Click here to receive each post in your E-MAIL

Read MoreSave Money For Next Christmas – Part 4

In this series, we are learning how to ensure we pay cash for next Christmas! Step 1 Determine how much money you want for Christmas next year The goal in this step is to use the Mini-Budget Form (Excel) to determine the amount of money that you want for next year's Christmas. Step 2…

Read MoreSave Money For Next Christmas – Part 3

In this series, we are learning how to ensure we pay cash for next Christmas! Step 1 Determine how much money you want for Christmas next year The goal in this step is to use the Mini-Budget Form (Excel) to determine the amount of money that you want for next year’s Christmas. Step 2…

Read MoreSave Money For Next Christmas – Part 2

This is the latest series brought to you by www.JosephSangl.com! The goal of THIS SERIES is to equip you to pay CASH for next Christmas! Step 1 Determine how much money you want for Christmas next year The goal in this step is to use the [download#3#nohits] to determine the amount of money that…

Read MoreSave Money For Next Christmas – Part 1

Welcome to the latest series brought to you by www.JosephSangl.com! It is the day after Christmas, and you have just ran up a pile of debt on your credit cards again. It was fun to give great gifts, but it was not fun putting the purchases on the credit card. If this is you, welcome…

Read MoreMy VISA debit card number was stolen …

Last weekend, my lovely bride was Christmas shopping on-line. On Monday, I went to my bank's on-line site to make an on-line bill payment (I LOVE on-line bill payments!) Here are some of the charges that I saw … Now, I knew that she had been shopping on-line, but I didn't know that it was…

Read MoreAbout Joe

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of Fully Funded Life (previously I Was Broke. Now I’m Not.), the president and CEO of INJOY Stewardship Solutions, and Co-Owner of MinstryDeal.com.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.