Archive for July 2020

How Do I Stop Impulsive Spending?

Recently, I was teaching the Financial Learning Experience at my local church when I had a gentleman raise his hand and asked this question.

“How Do I Stop Being Impulsive?”

My answer? I don’t know to stop the impulsive nature, but I DO know how to control my impulse to spend recklessly.

I am a SPENDER. I am the type of person who would go out and accidentally buy a truck. I am a spender to my very core. I like buying things. You could say impulsive spending comes naturally to me. The best way I’ve found to combat my impulse to spend is being intentional about my finances.

Here are some steps I have taken that helped me reign in my impulsive spending nature, and it has allowed us to win financially!

A Written Spending Plan

The first thing that helped me reign in my impulse to spend is putting together a written spending plan EVERY month BEFORE the month begins. Jenn and I continue to do this EVERY month BEFORE the month begins. Did you catch that? EVERY month.

The first thing that helped me reign in my impulse to spend is putting together a written spending plan EVERY month BEFORE the month begins. Jenn and I continue to do this EVERY month BEFORE the month begins. Did you catch that? EVERY month.

It reinforces the fact that we cannot flippantly spend our money and expect to succeed. When you have personally helped prepare the spending of your money on paper, you are much more aware about whether or not you can afford the “I WANT THAT!” item.

Having a written plan means that each month you have already told your money where to go on paper before the month even starts. Instead of wondering, “Can I afford this?” or thinking “Maybe it will be okay just this once,” you already know the answer. You know what you have allocated for each category, and if you spend impulsively how it will break the budget.

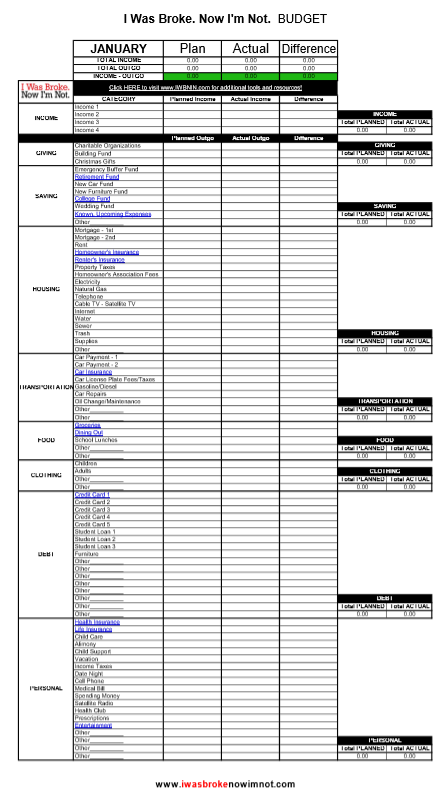

Jenn and I use the budget forms that are available on the TOOLS page of our website. If you want more information about how to start budgeting check out our post “How Do I Budget?” for tips on how to get started. Trust me, the word budget doesn’t have to send chills up your spine. I can, and it will help you win with you money!

Cash Envelopes

Like I said before, I am an impulsive spender, but even I will not impulsively spend money on the electric bill. I won’t impulsively purchase gasoline. I don’t impulsively send extra money to the cable company. There are some things that I am not going to impulsively spend money on.

However, there are some things that I am VERY impulsive about. Items like groceries, dining out, clothes, spending money, and entertainment. I can go through some money really fast with these items! Since I know that I am impulsive for these spending categories, I use cash envelopes.

However, there are some things that I am VERY impulsive about. Items like groceries, dining out, clothes, spending money, and entertainment. I can go through some money really fast with these items! Since I know that I am impulsive for these spending categories, I use cash envelopes.

At the start of the month we add up the amount we have put in the budget for these categories. We then pull that amount out in CASH. The rule is that we can not pull more money out from the bank AND we can not use the ATM or debit card. I can not overspend cash.

To read more about why I LOVE cash envelopes check out this post.

Chop Up Credit Cards

You may pay yours off every month, but the vast majority of Americans do not. I was part of the vast majority, and I had to admit that I was a completely loser with credit cards. I ran those stupid things up three different times. I was stupid with them. They really catered to my impulsive nature. So I did what had to be done and applied the scissor blades to them and shut the accounts down.

You may pay yours off every month, but the vast majority of Americans do not. I was part of the vast majority, and I had to admit that I was a completely loser with credit cards. I ran those stupid things up three different times. I was stupid with them. They really catered to my impulsive nature. So I did what had to be done and applied the scissor blades to them and shut the accounts down.

After years of not using credit cards I do have them again now. How do I keep myself in check? Well, I still don’t use them on things I am impulsive about. Can I use them to pay utility bills? Yes! Can I use them to book travel for work trips? Yes! Do I use them for my spending money that I have budgeted for each month? Absolutely NOT!

Many of you are like me – you need to kill the bad spending habits, and the only way to do that is to get rid of the card. If you are able to have them later on you have to make sure you have accountability in place – like a budget that you review with your spouse or not using them for things you are tempted to overspend on.

How do I eliminate the credit card debt I already have from impulsive spending?

Maybe you are thinking, “Joe, that sounds great, but I’ve already wracked up credit card debt.” If you have questions about how to pay off credit card debt check out our post “You Can Be Debt-Free.” You can also listen to our Monday Money Tip podcast episode on “0% Balance Transfer Credit Cards” or check out options of 0% balance transfer credit cards on our Next Steps page to see if they can help you eliminate your credit card debt.

If you are a fellow spender, what have you done to control your impulsive spending habits?

Let there be…TIME

Sometimes the best cure for the “I wants” is time. The moment we see it we want it, however if we wait to purchase sometimes the desire fads.

If today you see the shiny new motorcycle your neighbor just bought you may think “I want one.” Don’t run down the street to your local dealership and purchase it right away. If you wait a few weeks it will bring clarity. “That motorcycle is awesome, however I really would rather save up for a boat that my whole family can enjoy.”

The more time between the “I WANT THAT!” moment and the actual “Purchasing Decision” moment, the clearer the decision will be. Impulsivity can lead to buyers remorse, and a slue of unnecessary things filling your home that you really don’t need (or want for that matter).

Seek Advice

One of the best ways to stop impulsive spending is to seek guidance from someone you trust and wants to see you prosper. I’ve said this before and I’ll say it again (and again and again), find wise financial counsel. If you are married include your spouse.

Having someone else invested in seeing you succeed financially creates accountability and will encourage you along the way. It’s a lot easier to stay the course, and stop the impulsive spending when you know you are going to have to answer for the purchases you’ve made.

Stay The Course

We are ALL impulsive. It seems to be different things for each of us, but we all have a case of impulsiveness every now and then.

If you do get off course – make the rash purchase – don’t let it derail you. Tomorrow is a new day, and a new opportunity to make wise spending choices. Look at what lead to your impulse purchase, and think about ways to prevent something like that in the future.

I wonder if any of you out there would share some “near misses” where you almost made a horrible, snap-judgment financial decision but you did not. What helped you make the decision to back out? How does it feel now as you look back on the situation?

Budgeting When You Have Irregular Income

Do you have irregular income? Maybe it is seasonal or cyclical.

There is a large group of folks whose family economy is powered by irregular income.

Real estate agents, hair stylists, commissioned salesmen, and business owners all experience seasonal or cyclical income.

Folks who live with this type of income often tell me that it is impossible to budget. They say that they have no idea what they will make this month, so it is just impossible.

I say that not only is it possible, but that folks with irregular income need to be budgeting more than anyone!!!

In this post, I will explain how to prosper while earning irregular income. It is my goal to help you stop living the feast and famine lifestyle that is so often associated with irregular income. Here’s a hint – It’s EZ!!!

Step 1 – Recognize it!

To avoid living the feast/famine lifestyle, you must recognize that you have irregular income! If you have ever suffered during the “off” season, you KNOW what I am talking about! In order to stop having your life severely impacted by “off” seasons, you must prepare! It’s not enough to acknowledge you have irregular income, you have to decide to do something about it.

Question: If your family economy is powered by irregular income, what do you do to prepare for “off” seasons?

Step 2 – Determine monthly expenses

The next step is to determine how much money is necessary to make the household operate efficiently for each month. This is key to living free from the feast and famine lifestyle. To determine your monthly expenses, you should pull up a monthly budgeting form and do the following.

-

Fixed Expenses

Enter all your fixed expenses – house payment, utilities, gasoline, car payments, credit card payments, groceries, cell phone, childcare, etc. This also includes SAVING for retirement!

-

Variable Expenses

Enter the average of all your variable expenses – clothing, spending money, entertainment, dining out, etc.

-

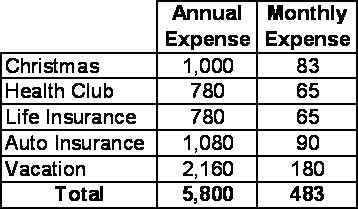

Known, Upcoming Non-monthly Expenses

This is a KEY STEP!!! If you do not add in all of those known, non-monthly upcoming expenses, you will continue to live the feast/famine lifestyle (more likely the famine lifestyle!!!!). These types of expenses are BUDGET-BUSTERS. Here is what I do. I list all the known, upcoming non-monthly expenses and place their annual cost next to them. I then divide that number by twelve to determine how much I need to save per month.

Example of Known, Upcoming Non-monthly Expenses

There are lots of expenses that we all have that are non-monthly, but we know how much they will cost us. Some examples are car insurance, car tags, life insurance, or gym memberships. In this example I have five annual expenses that I need to plan for. I would include a line item of $483 in my monthly budget for “Known, Upcoming Non-monthly Expenses”. This allows me to bring a stop to the feast, famine lifestyle by saving for items that I know are coming!!!

Want to read more about planning for known, upcoming non-monthly expenses? Click HERE.

You now have a monthly budget that will change very little through the year!

Question: What have been the biggest budget-busting expenses you have experienced?

You have successfully completed Step 2 – Determine monthly expenses!

Now, of course, the trick is to have enough cash on hand every month to make this monthly budget work! Ahhhhh, that my friend leads us to step 3!

Step 3 – Save up three months’ worth of expenses

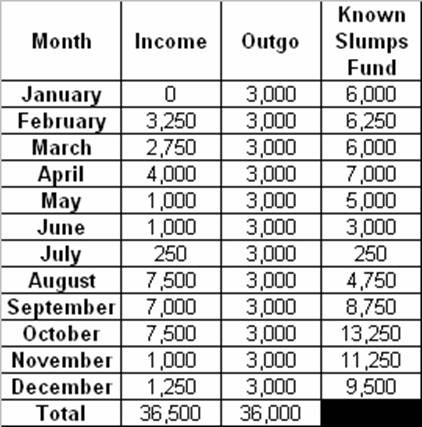

WHAT?!!!! I am sure that is what many of you are saying right now! Yes, I did say that you need to save up at least three months of expenses. Remember in step two that you calculated your monthly expenses? Multiply that number by three, and you have your savings target. I call this savings the “Known Slumps Fund”! You know that slumps are coming, so be prepared!!! This is HUGE in eliminating that horrible feast/famine lifestyle!

WHY?!!! You might be asking this question. Why on earth should I save up at least three months’ worth of expenses? Man, I am glad you asked that question!

How a “Known Slumps Fund” Works

Let’s say that you have monthly expenses of $3,000. This means that you need to have at least $9,000 in your “Known Slumps Fund”.

Let’s look at a year’s worth of expenses. Now, it is easily seen that this person has earned enough to make it this year. They have taken in $36,500 for the year. BUT look at how irregular the income is! Have you seen something like that before in your business? This causes life to be CRAZY. In January, you are eating ramen noodles like they are going out of style. February through April are decent, but then it dies again May through July. Famine of the worst degree! All of the sudden, August through October are awesome! Feasts abound! Then November and December come in with back to back terrible incomes. Back to the ramen noodles!

What should you do? Get a “Known Slumps Fund” that equals three times your monthly expenses!

Let’s see what difference that makes!

When you look at this chart you realize the POWER of having three months expenses in the bank! Whether you have a $500 month or a $6,500 month, you live on $3,000 that month. That means that you get to EAT!!! You can save money (remember the monthly expenses includes retirement savings!). That means that you can have some fun each month!

The “Known Slumps Fund” absorbs the irregularities of your income! Fill up your “Known Slumps Fund” – it will take so much stress out of your life!!!

Question: Which is more important to you – debt reduction or funding your Known Slumps Fund?

Step 4 – Become personally debt-free and operate your business debt-free

Now, I am certain that you believe I have completely fell off my rocker. You might be saying, “Joe, you are crazy! There is no way I can do this!” Well, I have seen many people operate their business debt-free.

What are the advantages of operating a business debt-free? Let me count the ways!

- Monthly expense load drops! There are no interest payments to make!

- Your business can absorb downturns much more effectively. Again, there are no interest payments to absorb!

- Breathing room. It is amazing how much stress a pile of debt brings on.

- When you spend your own real money, you will manage it better. I don’t know why this is, but if I am spending someone else’s money (i.e. the banks) I am much more susceptible to make a riskier decision! When I am spending my money, I am much more likely to do thorough due diligence before doing a deal!

Question: What are some other advantages of operating a business debt-free?

Budgeting with Irregular Income is Possible

So, don’t let your irregular income keep you from budgeting. Recognize that you have seasonal or cyclical income so you can avoid the feast or famine lifestyle. Next determine what your monthly expenses are. These include your fixed monthly expenses, variable expenses, and your know upcoming non-monthly expenses. Then save up three month’s worth of expenses in a “Known Slumps Fund” to help you weather those months when your income dips drastically or stops. Finally, live personally debt-free and operate your business debt-free. This isn’t something you can achieve overnight, but this goal will help you make tough choices along the way to set yourself up for long term success. Remember, budgeting with irregular income is possible!

Looking for additional Personal Finance Resources? You can obtain free tools by clicking HERE and purchase books/materials by clicking HERE.

I Lost My Job – Now What?

In a time of increasing unemployment and job loss, I thought it might be helpful to write this post. It is my hope that it is a help to those who have experienced a job loss.

Step One – Prioritize. Prioritize. Prioritize.

When you lose your job and paycheck, all expenses must immediately be prioritized. Some expenses might need to be reduced, and others need to be eliminated.

The best way to start is by eliminating expenses that are “wants” rather than “needs.” Let me be state some items that are “WANTS”. Cable/satellite TV, internet (YES! If you’re not using it for work or school it isn’t a necessity), home phone, dining out or take out, entertainment (the type that costs money), subscriptions, and clothes.

Let me be clear, I have met hundreds of people who have “tried to hold on” to items that were WANTS not NEEDS.

Here is my general order of priority for expenses:

- Food & Medicine (groceries – off brand/generics)

- Housing/Utilities (loan, insurance, taxes, utilities)

- Transportation (loan, insurance, taxes, gasoline)

- Secured debts (boat, motorcycle, four wheeler, furniture, etc.)

- Unsecured debts (credit cards, student loans, etc.)

Take some time to put together a written spending plan. Once all of the expenses are itemized, prioritize them based on what type of expense they are.

Step Two – Understand and Fill The Gap

I have met a lot of people who are so overwhelmed with making their financial ends meet that they have given up hope. They have let their emotions convince them there is no hope of making it work at all.

This is not the case! It CAN work. It CAN be dealt with! It’s NOT hopeless! However, you must understand the gap and fill it.

What is the gap? The gap is the amount of additional money needed to make the budget balance. While the US Government might print more money to “fix” the situation, we cannot do that (although it does come with free room and board if you do print your own money).

Prepare a written spending plan using the priorities discussed in Step One. This will allow you to understand the gap.

How do you fill the gap? Well, using our equation, INCOME – OUTGO = EXACTLY ZERO, there are two ways – reduce OUTGO or increase INCOME.

Reduce OUTGO

- Eliminate unnecessary expenses (cable, subscriptions or memberships, home phone, cell phone)

- Re-quote homeowners (or renter’s) and auto insurance

- Modify entertainment to no-cost and low-cost options (movies from library, hiking, swimming at the lake, fishing, Hulu.com)

- Eliminate health club membership (run outside)

- Sell the car and purchase a paid-for beater

- Buy off-brand groceries, use coupon services, shop at Aldi, prepare more food at home

- Carpool to work

- Work from home

Increase INCOME

Apply for jobs like crazy – Monster.com, Zip Recruiter, Career Builder

Apply for jobs like crazy – Monster.com, Zip Recruiter, Career Builder- Get a job – any job will do for the short term – contract/temporary positions, deliver pizza, clean houses, fast food, grocery store clerk, work for a family member, commercial cleaning, deliver newspapers

- Sell stuff – yard sale, Ebay, Craigslist, Facebook Marketplace – that big ticket item you’re holding onto could be the key to getting you through this season

What other ways would you or have you increased INCOME or decreased OUTGO?

Step Three – Stay Away From The Doubters, The Naysayers, and the No-sayers

I have seen it countless times. A person is in a financial pickle and is pursuing income, and they allow others to shoot down their ideas for generating additional income or reducing outgo.

Here are some examples:

- “You don’t need to get a second job. Think about how hard that would be.” Oh, so this is supposed to be easy?

- “You can’t possibly get employed there. They only hire such-and-such type of people. Not you.” If you don’t apply, you DEFINITELY will not get the job!

- “Why would you sell your motorcycle? I will go broke before I sell mine.” Always check the financial advice against the financial condition of the advice-giver.

- “Why would you go to a financial counselor? That is just admitting that you are in a bad financial situation, and they will yell at you for it!” Look, the fact is that it is a tough financial situation. As a financial counselor, it does no good to yell at someone about past financial mismanagement or a tough financial situation. A good financial counselor is focused on preparing a plan to walk out of the current crisis and prevent future ones.

- “Your grandparents struggled with money. Your parents struggled with money. You will struggle with money.” Wrong. Just plain old wrong.

Remove the negative people from your life. Focus on using this job loss as an opportunity to go do something you have always dreamed of doing or as a stepping stone to get toward your calling.

I wonder what other negative statements you have heard (or are hearing) as you went through a job loss?

Step Four – Never Give an Employer Such Power Again

If you have been laid off and are panicking about what to do, let me ask you a question.

If you had $20,000 in the bank, would you be as panicked as you are right now?

I suspect the answer would be, “Not nearly so much as I am right now,” or “Not at all.”

When you build a HUGE emergency fund of at least six months’ worth of expenses, you build a hedge of protection around you. It protects you from being horribly impacted by your employer’s decision to cease your employment.

Do not get me wrong. A pile of money does not address all of life’s issues, nor is it a worthwhile item to place one’s trust in, but it is excellent stewardship to hold financial reserves. It just makes sense!

Taking Control of Your Financial Stability

So … If you have not experienced a job loss, resolve today to build up an awesome emergency fund to protect yourself in the future.

If you have lost your job, resolve to do what you can to help your financial situation.

You CAN do this! Saving up a ton of money and denying yourself of some wants might not be fun in the short term, but it is SO WORTH IT!

Taking action can help you minimize the negative financial effects of a job loss. Remember these steps, and don’t be afraid to get started TODAY.

First, prioritize your expenses so you know what they are and which are the most important to pay. Second, understand and fill the gap. During a season of unexpected job loss reducing your expenses and looking for creative ways to create new income can help you bridge the gap until you find steady employment again. Third, don’t listen to people telling you your situation is hopeless. Surround yourself with people who will encourage to make tough decisions that will help you in the long run. Selling that motorcycle or taking the part time job may not be your first choice, but it can help you win in the long run. Finally, resolve to build up a large emergency fund so in the future an unexpected job loss doesn’t have the power to derail your finances.

If your job or income has been affected by COVID-19 we have free resources to help you on our website.