Why Smart People Sometimes Do Stupid Things With Money

Why do smart people sometimes do stupid things with money?

I’ve seen really smart people make strange financial decisions.

- Bought a brand new car and financed 106% of it (sales tax and all!)

- Go to college and finance it 100% with student loans while obtaining a degree comparable to a degree in basket weaving

- Go on a very expensive vacation to Hawaii and put 100% on their credit card and have no money to immediately pay it off

- Withdraw all the equity out of their home to start an unproven new business

These types of decisions are made every day by very smart people! Perhaps even YOU have made one or more decisions like this. You may have to only look into the mirror to see someone who has done one or more of these financially horrendous items. I know that is as far as I have to look!!!

Back to my question. Why do smart people sometimes do stupid things with money?

Possible Answers

- No plan. They wanted to spend the money on the item, but they did not plan for the expense. Consequently, they only money available when the purchase was made was very expensive debt.

- No self-control. They wanted it! They wanted it now! They did not want to wait. No! Must have item … Must have item now … Will be emotionally scarred for life if item is not obtained now …

- Hope I can pay for this. Not willing to face up to the fact that they can’t have an item now, but they buy it anyway hoping that “the money will come from somewhere.” The reality is that “hope is not a strategy” and this usually leads to tremendous financial penalties.

- Talked into it. See #1, #2, and #3. You’ve seen it happen. The friends start talking about it. The friends are going on the vacation. The friends have the new car. Your friends are going to college and are not having to work while there. Justification is found through others’ circumstances.

If I were to attempt to sum the reasons that smart people sometimes do stupid things with money, I would say it is because they were ignorant of the REAL and LONG-TERM COST of those major financial decisions. If they truly knew the COST of those decisions, many tears of sorrow and regret and many money fights with their spouse could be avoided.

Known, Upcoming, Expenses – Capital One 360 Sub-Account Tracking

//This blog post was written by Joe Ziska – I loved this idea so much that I personally implemented it with my Capital One 360 accounts!//

Q) What two things do the following have in common?

Christmas; A flat tire; Your son going to college; Vacation in Hawaii; Your daughter getting married

A) 1. They all cost money. 2. We forget that they cost money until the bill comes!

Let’s face it. Even the most organized of us tend to forget things now and then. Whether misplaced car keys or forgotten reservations for Valentines Day, our imperfect memories always seem to make life more difficult. In my experience, forgetting large upcoming expenses is one of the most demoralizing things that can happen to you. Unlike true emergencies, such as a sudden illness or job loss, known upcoming non-monthly expenses (KUEs) such as these listed above, can and should be expected! As Joe always asks, “Should it be a surprise if your car breaks down?” Of course not. That’s what cars do!

Many of you reading Joe’s blog are trying desperately to get out of debt and gain financial freedom. For my wife and me, one of the most disheartening things in that process was a big expense wiping out our emergency fund. Just when we felt we were finally getting traction, a $500 car repair or having to pay for Christmas presents would knock us off course. We constantly felt like we were starting over. I knew that we should be saving for these expenses but didn’t have a good way to separate this from our emergency fund. We’d generally leave a decent balance in our checking account and just hope that it would absorb most of these expenses when they came up.

I wanted to save for these KUEs. However, the mathematical part of me rebelled at the idea of gaining no interest on our savings (especially as some of these expenses can be quite costly). Wouldn’t it be better to just pay down some debt or invest the money?

Enter Capital One 360. I’d been using HSBC and Capital One 360 to earn good interest on money we were saving for a down payment for our house. However, it wasn’t until almost a year after opening our accounts that I realized how they could help with my KUE problem.

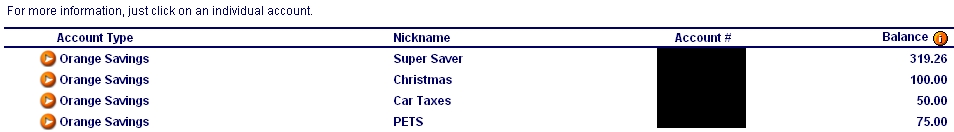

One day, I was checking my account balance online and I noticed a large button labeled “Open an Account”. I figured this was used for investing or to open a new CD but clicked on it anyway. After browsing for about 30 seconds, I realized that Capital One 360 will let you create numerous new savings accounts linked to your original account. Not only that, you can give each a unique name to help you identify them. We created categories for all of our Known Upcoming Expenses to keep them separate from actual emergencies. Below is an example screenshot from an account (click on it to see it better):

We have also set up automatic transactions to each individual account. So now, at the beginning of every month we move $12 to our pet fund (unfortunately, our dog doesn’t pay her own vet bills), $40 to our Christmas fund, and so on. When we need the money for these expenses, it takes only 3-4 days to move it back to our primary checking account. Meanwhile we’ve been earning interest on our money instead of paying interest to a credit card company when these events sneak up on us. Last time I checked, Christmas is still in December so you’ve got 5 months to save up for all those gifts. Why not create an account for it and make it automatic?

========= End of Guest Post by Joe Ziska ===========

Thanks for the article, Joe!

Strategies For Saving Money

One of the largest issues I see during our one-on-one financial coaching meetings is the inability to save money.

Here are some facts about saved money:

- Saving money is essential to long-term sustainability

- Saved money relieves stress

- Saved money allows you to take a chance

- Saved money allows life to happen (job loss, disability, pay cut, injury, etc.) without going broke!

But you already knew that part. We all know that we are supposed to “save money for a rainy day.” Yet, even though we KNOW how important it is to save money, most people fail to do so.

My hope with this blog post is to challenge YOU to take a next step. If you have negative savings (no money plus overdrafted accounts and debt), the goal is to bring you to zero. If you are at zero savings, the goal is to get to at least $2,500 in a beginner emergency fund. If you have been able to save a substantial amount of money, it is my hope that you will participate in the discussion and share your own tips that have worked well for you.

Automatic Draft From Paycheck

Establish a savings account and have the money drafted from every single paycheck. Whether it is $25 or $250 per pay period – just SAVE! You KNOW that the car is going to break down. You KNOW that the school is going to send home a surprise expense.

By establishing this draft, it allows the money to be “out-of-sight.” When money is out-of-sight, it can be out-of-mind. This allows the account to grow without you robbing it!

Now, I personally had a problem with this when I did not have a monthly budget. I would ROB my own savings account about 2.1 microseconds after I was paid. Only after I had a plan developed together with my bride, Jenn, did my savings account begin growing in a healthy manner.

Create An Escrow Account For Known, Upcoming Expenses

For those unfamiliar with an escrow account, it is a savings account that is established by a mortgage company. The mortgage company totals the annual cost of property taxes and homeowner’s insurance and divides it by the number of payments being made each year. The mortgage company then pays for the taxes and insurance from this escrow (savings) account. For example, if the property taxes are $1,200/year and the insurance is $600, then the total amount needed each year is $1,800. The mortgage company will collect $150 extra with each monthly payment to place into the escrow account.

An escrow account smooths out the cost over a year – instead of having to pay for it all in one month. It tightens the monthly budget, but having a fully funded escrow account sure is AWESOME when vacation arrives and the money has already been saved to pay cash for it! Those who have a mortgage with an escrow account will testify to the fact that they never worry about paying for the taxes and insurance – ask someone!

Take a moment to read THIS POST about how to calculate the amount you need to save each month for your known, upcoming expenses.

Take it from one who has lived it – if you do not plan for your known, upcoming expenses, your ability to save money will be tremendously hampered!

How about you? What are some ways you have made saving money easier in your own finances?

NOTE: I hold my Known Upcoming Non-Monthly Savings in an account at Capital One 360. It allows me to save money “out of sight – out of mind” and allows me to create “sub-accounts” for each item I am saving for. For example, I have created a “Christmas” and “Car Replacement Fund” in my account. You can check out Capital One 360 HERE.

4 Reasons It Is Hard to Budget

As I assist others in the creation of budgets that actually work, I see certain issues that crop up very frequently. In fact, here are four reasons that budgeting is difficult for many people.

4 Reasons It Is Hard To Budget

1. Unwillingness to change behavior. A refusal to recognize that INCOME – OUTGO = EXACTLY ZERO will not eliminate this fact from being reality. If someone is unable to pay their bills, but they are still getting weekly manicures – something is wrong! If someone is unable to pay their bills, yet are still spending a ton of money eating at restaurants – something is wrong! Behavior MUST change in order to move from “surviving” to “thriving” financially.

2. It is not about money at all. It is a TRUST issue. You want to see power struggles in a marriage? Get them to talk about their money! I believe a lack of trust is a HUGE reason that it is hard for many couples to budget. It is about trust. Here are some of the questions being asked.

- Do I TRUST you enough to put our money together into a single checking account?

- Do I TRUST you enough to let you pull cash out for spending money?

- Do I TRUST you enough to follow our written plan – the budget?

- Do I TRUST you enough to hear your opinion about where we should spend our money?

- Do I TRUST you enough to believe that we really need to spend that much money at the grocery store?

- Do I TRUST you to do well in the future! – Because you have messed up with money in the past!

3. One spouse is not interested in working with the other. This will kill a budget before it ever starts! I have seen multiple examples where one person works like crazy to get their money in order, only to have the unfortunate surprise that their spouse has run up a huge credit card bill, or shows up with a new car, or buys a new boat, or signs up for an expensive vacation, or … The list goes on and on. When this occurs, the “behaving” spouse (who has been following the spending plan) becomes very tempted to throw in the towel and join in with the frivolous spending. They reason, “Well, if he/she can have what they want, I deserve it too …” Couples who do not work together on major financial decisions run a high risk of not maximizing their financial potential. They also run a higher risk of divorce.

4. Failure to recognize that there is an “INCOME” portion to the INCOME – OUTGO = EXACTLY ZERO equation. Seriously, I can’t believe I have to write this, but it is SO true! I have people show up for counseling, and they are not working! Now, I can understand a couple of weeks without work (maybe), but I REALLY DO NOT UNDERSTAND HOW SOMEONE COULD NOT WORK FOR SIX MONTHS! How is this possible? GO TO WORK! DO SOMETHING! Go get a job. I don’t care if it makes someone feel sad to take a job at McDonald’s! It makes me feel sad when they draw welfare for 6 months when they have ABSOLUTELY NO REASON that they cannot work – except for “it makes me feel bad”. Waaah! Earn some money. It will help cure depression.

Well, I have ranted enough today. I know that it can be difficult to budget, but I believe that you can do this! I believe that you have the know-how, the capability, and the inner-strength to work together with your spouse, avoid the debt trap, develop a plan for your life, and have fun doing this together!

YOU CAN DO THIS!

You CAN have a budget that really works! Check out our FREE BUDGET TOOLS to get started.

My book, I Was Broke. Now I’m Not., can help you learn to live and operate with a monthly budget and begin to fund your dreams. Purchase your copy today and get started!

ING: How Much Money Do You Need To Retire?

If you have read this website with any regularity, you will know that I am a freak about having a financial plan. I want a written and very detailed plan for anything related to my finances.

One thing that I teach during live events is the importance of calculating how much money you need to retire. It is also taught in my book, I Was Broke. Now I’m Not.

It is SO IMPORTANT to know how much money is needed to retire well.

How much money do you need to retire?

One of my favorite on-line banks, has created a terrific website to help you answer the question. I went to the website and calculated my number, and it FIRED ME UP!!!

I enjoyed the brief exercise so much that I want to CHALLENGE to everyone today to take five minutes to complete the following two tasks (trust me, it will be worth it):

- Calculate Your Number at INGYourNumber.com

- Calculate Your Number using the JosephSangl.com “Retirement Nest-Egg Required Calculator“.

Are YOU going to be able to retire well?