THE MISSION:

HELPING YOU ACCOMPLISH FAR MORE THAN YOU EVER THOUGHT POSSIBLE WITH YOUR PERSONAL FINANCES

Resources To Get You Financially Free

THE LATEST FROM MY BLOG

How much is enough?

When will you have enough? Is it when you finally own your home? How about when you finally get to purchase that awesome boat? What about a vacation home? What about when you own your own business? What about when you own a farm? Is it when you hit $1,000,000 in the investment account? What…

Read MoreWhy do you want to be financially free?

Do you ever wonder why I write so much about becoming financially free? I want to become financially free because I believe that I am a better person when I am not living paycheck to paycheck. I believe that I am a better husband when I am not worried about where the money is coming…

Read MoreUnexpected money

If you have a detailed financial plan (a monthly zero-based budget) and you receive unexpected money, you will know exactly where that money can be put to good use. If you do not have a plan, there is a good chance that the money will leave you quickly. Marketers understand our ability to impulse purchase…

Read MoreMoney Tips

Negotiate with service providers on major purchases (like a crown at the dentist or a surgical procedure at the doctor). The world is full of service providers – get a deal! If you have kids and a spouse, get good level term life insurance!!! You can get good quotes at Zander. Budget for a vacation…

Read MoreBudgeting Tips

I have some budgeting tips that have worked for me. If you have any additional ones, I would love to learn them! Tips 1. Use a computer spreadsheet if at all possible (Excel, Quattro Pro, etc.). This takes the math out of the calculations. If you remember something that needs included in the budget, you…

Read MoreBOO to the non-savers. Down with you!

From USA Today last week: $575 – On average, U.S. households overspent their incomes by that much in January!!! Below the main headline is a line that states The negative savings rate worries some. WOW! It worries some?????? My goodness, what is it going to take to wake up???? What we are doing is NOT…

Read MoreAbout Joe

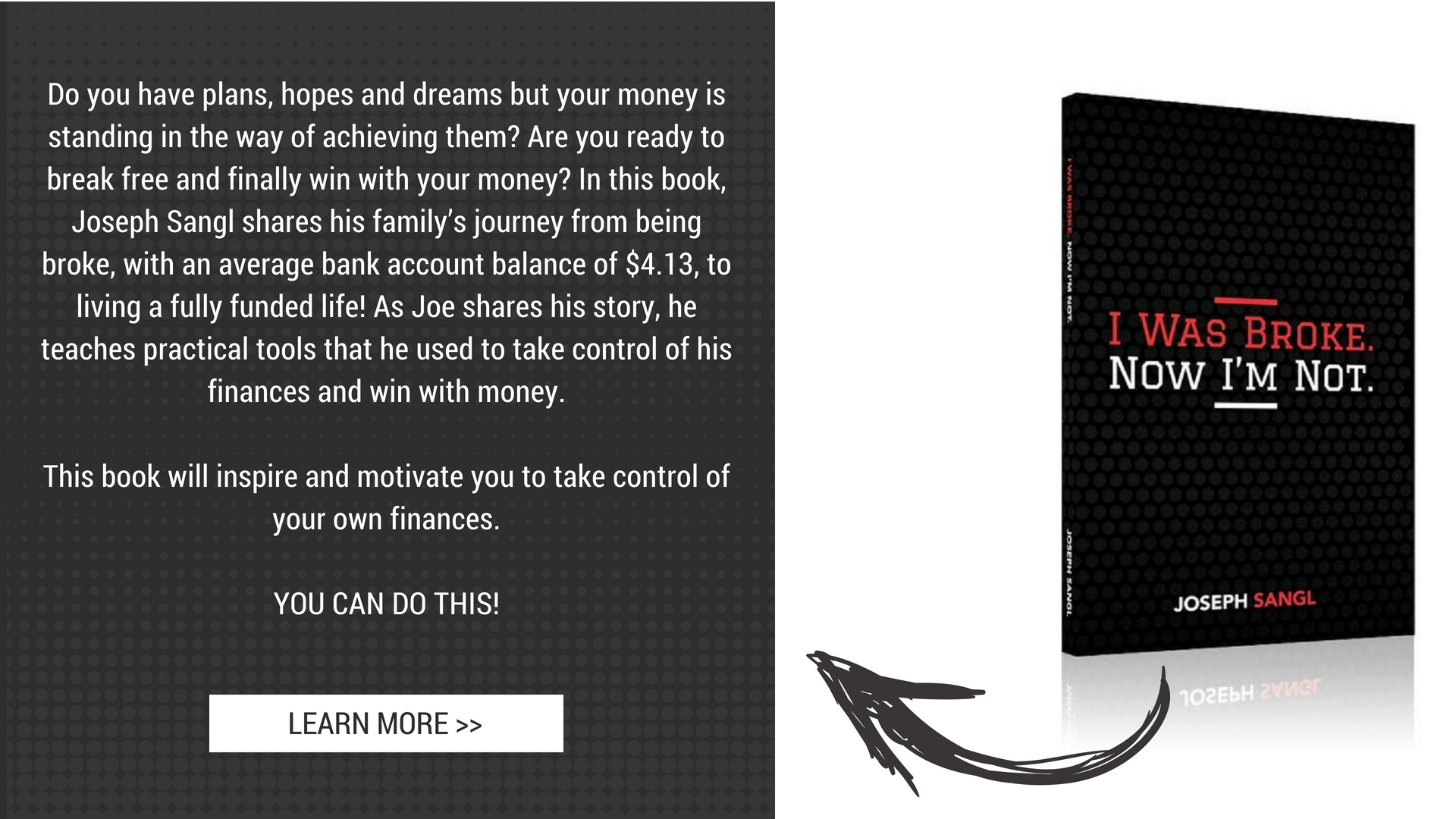

Joe is a leading teacher of personal finances. It is his passion to help people accomplish far more than they ever thought possible with their personal finances.

He is the founder of I Was Broke. Now I’m Not., the president and CEO of INJOY Stewardship Solutions, and Co-Founder of Fully Funded.

Joe is a graduate of Purdue University (BS Mechanical Engineering) and Clemson University (MBA). He is the author of several books and has been featured in Money Magazine. He has been privileged to share his passion with hundreds of thousands of people throughout North America through Financial Learning Experiences, personal finance messages and one-on-one financial coaching sessions.