Marching To Debt Freedom – Couple #2

Introduction

This couple has announced to their debt that they are breaking up with it. Their friendship with debt has waned and frankly, it's time for them to cut debt out of the picture.

It has now been three months since Couple #2 began their March Toward Debt Freedom! This PUMPS me up! Why? Because I know that the third monthly spending plan is when financial plans really begin to take off!

On to the update.

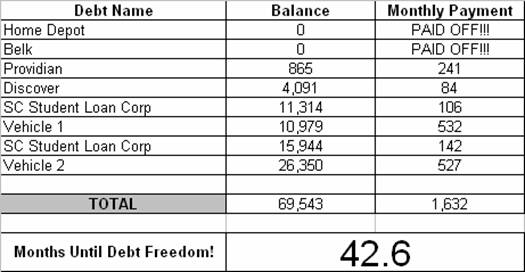

Here is their updated Debt Freedom Date calculation.

What went well this month …

Great news!! We paid off two credit cards; Belk and Home Depot!!! This will free up $125 to put toward paying off the Providian. We are so excited!! We did not accumulate any new debt this month either. The cash envelopes have really helped us to “live within our means.” We never thought of ourselves as “living above our means” before, but that is exactly what we were doing over the last several months. Thank God for Joe and his plan to help us become debt free. We have a ways to go, but I feel like a different person…like I have more control over our future.

Challenges and struggles for this month …

We had to practice saying NO this month. Both of our envelopes ran out of cash pretty fast, so we had to "just say no." In a way it was nice, but still tough. Sometimes we think we need to do everything just because we are asked, but now we have realized if it is not budgeted, we don't do it. Our family and friends were very understanding. I simply explained to them what we were doing and they were very respectful of our decisions. The cash envelopes take time to get used to, but in the long run we know if we say no today we can say yes in the future. Next month we are going to work on making the cash envelopes last longer.

One more thing…in the beginning, we estimated on how much we owe on our Student Loans and Vehicle One. However, we realized that we estimated a little high on Student Loan Two & Vehicle One and low on Student Loan One. We owe about $900 less on Student Loan 2, $500 less on Vehicle 1 and $400 more on Student Loan 1. Lesson learned…double check everything, even if you think you are correct. Luckily, we owe less than we thought, but it would not have been encouraging to learn we had more debt. This was irresponsible on our part, but I want to tell everyone just in case someone else out there did the same thing.

Sangl says …

I am so PROUD of Couple #2! They have made it through the three most difficult months of developing good spending plans. They are well on their way to Debt Freedom! I think it is awesome to see that the Debt Freedom Date has moved up 1.6 months from last month!

Couple #2 – Make sure that you are preparing for Christmas in your spending plan. You want to make sure that you can pay cash for Christmas and continue your awesome progress!

I am so appreciative that you are willing to share your journey with thousands of others!

Readers …

How has Couple #2 inspired you to take control of your finances? Would you leave a word of encouragement in the comments?

View past updates from Couple #2

Read recent posts on www.JosephSangl.com

![]() Subscribe for FREE to www.JosephSangl.com

Subscribe for FREE to www.JosephSangl.com![]()

Way to go couple 2. Also knocking out the debt demons. Although my wife and I are out of consumer debt seeing other people travel down this same path inspires us to pay off our house more quickly. In our first year of owning a home we paid off 10% of the mortgage (5% down 5% over the first year). My parents were shocked to hear we had paid off that much in one year.

Great Job! Thank you for sharing your ups and downs. We also are 3 months into our pursuit of debt freedom. And our envelopes are still being stretched each month, but knowing there are others that are sticking to it encourages us. Now let’s stick together and get through Christmas without going into any debt or borrowing from our emergency savings. WE CAN DO THIS!!

Hey there! I want to thank you for coming this past weekend to Revolution. We learned a whole lot and now my husband is staying up all hours of the night to get us in order. We have already been to Edward Jones and are getting the ball rolling to financial freedom. I want nothing more than to be financially set for my daughter, her college and our retirement! Thanks again!! You ROCK!